ISO 20022 Adoption and Migration for Cross-Border Payments

Cross-border payments operated based on the existing MT format for bank-to-bank messaging and settlements. Swift and the industry as a whole migrated to ISO 20022, thereby adopting a global and open messaging standard which all market participants and associated infrastructure can adhere to.

What is ISO 20022?

ISO 20022 is a global and open standard for financial messaging specified by the International Organization for Standardization (ISO). Aiming to be the common language for financial institutions, financial market infrastructure, and related participants, the adoption of ISO 20022 unifies current practices based on fragmented standards and provide the industry with highly structured and enriched data for end-to-end automation on an international scale. Along with Swift, a growing number of payment infrastructures have made the decision to migrate to ISO 20022 to address the challenges associated with increasing costs and inefficient processing in areas such as financial crime mitigation, operations, and data automation.

Migration from MT Format to ISO 20022 Standard

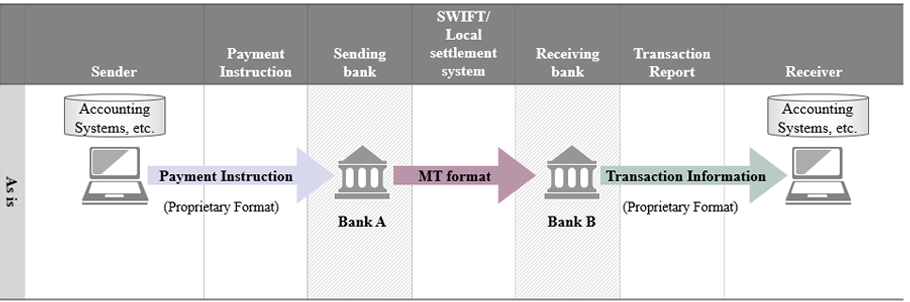

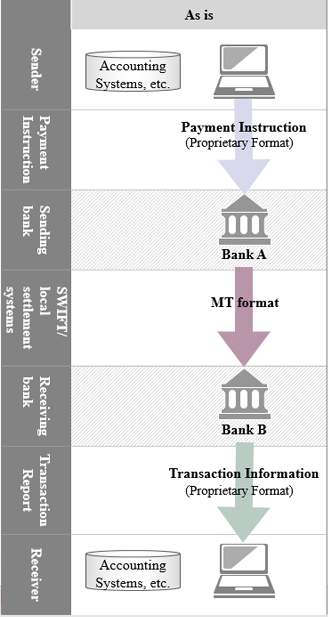

MT-Based Cross-Border Remittances

Cross-border customer payments are settled through financial messaging systems such as Swift and local settlement systems of respective countries. Although Swift uses a message format called MT format for interbank settlements, the flow of payment operates on fragmented standards due to local requirements and practices and service specifications set by financial institutions.

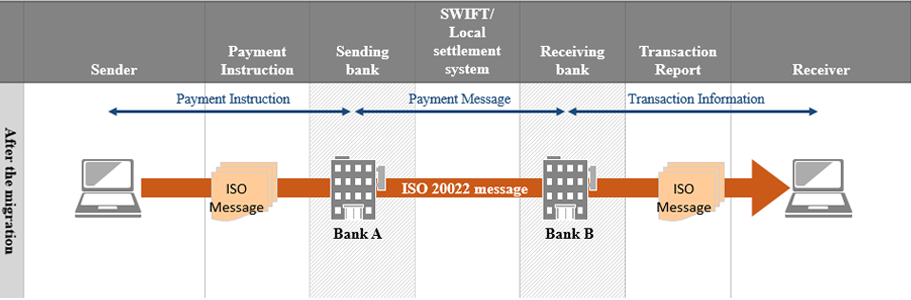

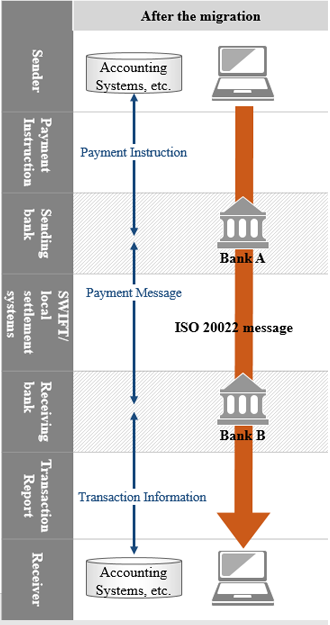

ISO 20022-Based Cross-Border Remittances

Swift migrated to ISO 20022-based messaging from March 2023 to November 2025. ISO 20022 will be adopted as a common standard across the flow of payment, allowing enriched data to be delivered end-to-end for faster processing, visibility and interoperability.

Example of ISO 20022 Messages

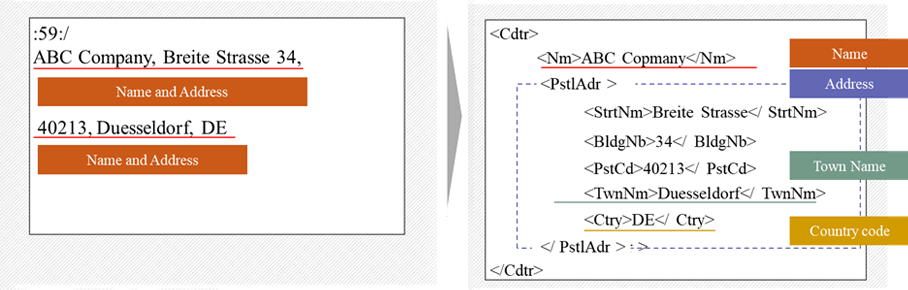

MT, the conventional standard, had limitations such as limited data fields and incompatible structures for data processing. As a result, many MT users customize the data settings in the MT data fields in order to reflect their messaging needs. This leads to disruptions in payment data processing by financial institutions and the inability to fully automate.

ISO 20022 messages are significantly longer, allowing more data to be entered in a hierarchical, structured manner.

For example, in MT format, payment beneficiary information is entered in a narrative manner in a single field (field 59) which includes multiple pieces of information such as the beneficiary name, address, city, and country.

In an ISO 20022 message, payment beneficiary information is entered in the creditor field, which includes the name and address as well as additional structured elements including street name, building name, post code, and town name.

ISO 20022 messages are significantly longer, allowing more data to be entered in a hierarchical, structured manner.

For example, in MT format, payment beneficiary information is entered in a narrative manner in a single field (field 59) which includes multiple pieces of information such as the beneficiary name, address, city, and country.

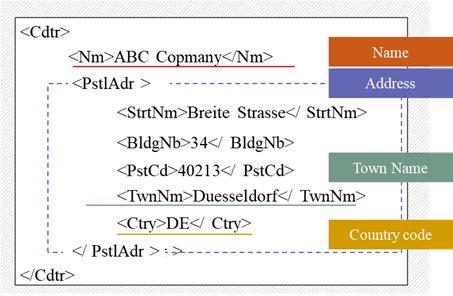

In an ISO 20022 message, payment beneficiary information is entered in the creditor field, which includes the name and address as well as additional structured elements including street name, building name, post code, and town name.

Payment Beneficiary Information in MT format

Payment Beneficiary Information in ISO 20022 Message

Payment Beneficiary Information in MT format

Payment Beneficiary Information in ISO 20022 Message

Impact on Customers

Swift abolished the MT format in November 2025, and MUFG has also stopped accepting MT format for outgoing remittances. Thank you for your cooperation in changing the format. For incoming remittances, until December 2026, When ISO20022 based incoming remittances are received, they are converted into MT format before processing and credit entries to customer accounts.

While the conversion process comply with the Swift guidelines, due to the increased data capacity of ISO 20022 compared to MT format, there is a possibility that for incoming remittances in ISO 20022, transaction reports or account statements may not fully reflect the enriched information available in the ISO20022 based remittances.

It will be remediated when MUFG starts ISO20022-based services for payment processing and information reporting.

More details are available in the FAQ.

While the conversion process comply with the Swift guidelines, due to the increased data capacity of ISO 20022 compared to MT format, there is a possibility that for incoming remittances in ISO 20022, transaction reports or account statements may not fully reflect the enriched information available in the ISO20022 based remittances.

It will be remediated when MUFG starts ISO20022-based services for payment processing and information reporting.

More details are available in the FAQ.

Swift's Vision for the ISO 20022 Migration

Expedited and Enhanced

payment processing

payment processing

- Format unification that allows faster settlement of payments across payment infrastructures

- Expedited processing for sanctions screening and financial crime mitigation

Enhanced Information

- Enriched data for increased machine readability and automation

- Scalable formats suitable for delivering a large amount of highly structured data

Business Benefits

- Enhanced customer service with the provision of rich payment data

- Increased opportunities for end-to-end automation from invoicing to account reconciliation

In the future, the movement to seek standardization at a higher level is expected to accelerate, potentially leading to the advancement of information utilization and various services.

(as of February 9,2026)

Frequently Asked Questions

ISO Overview

Incoming remittances