当座勘定規定

第1条(反社会的勢力との取引拒絶)

この当座勘定は、第27条第3項各号のいずれにも該当しない場合に利用することができ、第27条第3項各号の一にでも該当する場合には、当行はこの当座勘定の開設をお断りするものとします。

第2条(当座勘定への受入れ)

- 当座勘定には、現金のほか、手形、小切手、利札、郵便為替証書、配当金領収証その他の証券で直ちに取立てのできるもの(以下「証券類」という。)も受入れます。

- 手形要件、小切手要件の白地はあらかじめ補充してください。当行は白地を補充する義務を負いません。

- 証券類のうち裏書等の必要があるものは、その手続を済ませてください。

- 証券類の取立てのため特に費用を要する場合には、店頭掲示の代金取立手数料に準じてその取立手数料をいただきます。この当座勘定に旧券、旧貨や記念硬貨を受け入れるなど、当行所定の条件を満たす現金の取扱いの場合には、当行所定の取扱手数料をいただきます。

第3条(証券類の受入れ)

- 証券類を受入れた場合には、当店で取立て、不渡返還時限の経過後その決済を確認したうえでなければ、支払資金としません。

- 当店を支払場所とする証券類を受入れた場合には、当店でその日のうちに決済を確認したうえで、支払資金とします。

第4条(本人振込み)

- 当行の他の本支店または他の金融機関を通じて当座勘定に振込みがあった場合には、当行で当座勘定元帳へ入金記帳したうえでなければ、支払資金としません。ただし、証券類による振込みについては、その決済の確認もしたうえでなければ支払資金としません。

- 当座勘定への振込みについて、振込通知の発信金融機関から重複発信等の誤発信による取消通知があった場合には、振込金の入金記帳を取消します。

第5条(第三者振込み)

- 第三者が当店で当座勘定に振込みをした場合に、その受入が証券類によるときは、第3条と同様に取扱います。

- 第三者が当行の他の本支店または他の金融機関を通じて当座勘定に振込みをした場合には、第4条と同様に取扱います。

第6条(受入証券類の不渡り)

- 前3条によって証券類による受入れまたは振込みがなされた場合に、その証券類が不渡りとなったときは、直ちにその旨を本人に通知するとともに、その金額を当座勘定元帳から引落し、本人からの請求がありしだいその証券類は受入れた店舗、または振込みを受付けた店舗で返却します。ただし、第5条の場合の不渡証券類は振込みをした第三者に返却するものとし同条第1項の場合には、本人を通じて返却することもできます。

- 前項の場合には、あらかじめ書面による依頼を受けたものに限り、その証券類について権利保全の手続をします。

第7条(手形、小切手の金額の取扱い)

手形、小切手を受入れまたは支払う場合には、複記のいかんにかかわらず、所定の金額欄記載の金額によって取扱います。

第8条(預金の払戻し)

- この預金を払戻すときは、当座キャッシュカード規定によることとし、別途当行が認めた場合は、当行所定の本支店において、当行所定の払戻請求書に届出の印章(または署名)により記名押印(または署名)して提出してください。上記によるほか、小切手を使用することもできます。

- 前項の払戻しの手続に加え、この預金の払戻しを受けることについて正当な権限を有することを確認するため当行所定の本人確認資料や当座キャッシュカードの提示等の手続を求めることがあります。この場合、当行が必要と認めるときは、この確認ができるまでは払戻しを行いません。

第9条(手形、小切手の支払)

- 小切手が支払のために呈示された場合、または手形が呈示期間内に支払のために呈示された場合には、当座勘定から支払います。

- 前項の支払にあたっては、手形または小切手の振出しの事実の有無等を確認すること(その旨について書面の交付を求めることを含みます)があります。

第10条(手形、小切手用紙)

- 当行を支払人とする小切手または当店を支払場所とする約束手形を振出す場合には、当行が交付した用紙を使用してください。

- 当店を支払場所とする為替手形を引受ける場合には、預金業務を営む金融機関の交付した手形用紙であることを確認してください。

- 前2項以外の手形または小切手については、当行はその支払をしません。

- 当座勘定から支払をした手形または小切手のうちに、本人が振出したものではないものや改ざんが疑われるものがあった場合には、直ちに当行宛に連絡してください。

- 当座勘定から支払をした手形または小切手の用紙はその支払日から3か月を経過した場合は返却を求めることができないものとします。

- 前項の期間を経過した場合において、本人から請求があったときは、当行所定の手続きによって当該手形または小切手の写しを交付します。ただし、当行が定める写しの保管期限を経過した場合は、その限りではありません。

第11条(支払の範囲)

- 呈示された手形、小切手等の金額が当座勘定の支払資金をこえる場合には、当行はその支払義務を負いません。

- 手形、小切手の金額の一部支払はしません。

- 呈示された手形、小切手は、呈示日の15時までに当座勘定に受入れまたは振込みされた資金により支払います。

第12条(支払の選択)

同日に数通の手形、小切手等の支払をする場合にその総額が当座勘定の支払資金をこえるときは、そのいずれを支払うかは当行の任意とします。

第13条(過振り)

- 第11条の第1項にかかわらず、当行の裁量により支払資金をこえて手形、小切手等の支払をした場合には、当行からの請求がありしだい直ちにその不足金を支払ってください。

- 前項の不足金に対する損害金の割合は年14%(年365日の日割計算)とし、当行所定の方法によって計算します。

- 第1項により当行が支払をした後に当座勘定に受入れまたは振込まれた資金は、同項の不足金に充当します。

- 第1項による不足金、および第2項による損害金の支払がない場合には、当行は諸預り金その他の債務と、その期限のいかんにかかわらず、いつでも差引計算することができます。

- 第1項による不足金がある場合には、本人から当座勘定に受入れまたは振込まれている証券類は、その不足金の担保として譲り受けたものとします。

第14条(手数料等の引落し)

- 当行が受取るべき貸付金利息、割引料、手数料、保証料、立替費用、その他これに類する債権が生じた場合には、払戻請求書、小切手によらず、当座勘定からその金額を引落すことができるものとします。

- 当座勘定から各種料金等の自動支払をする場合には、当行所定の手続をしてください。

- 当行が別に定める時限以降に当座勘定に受入した資金は、入金日における各種料金等の自動支払には充当しません。

第15条(支払保証)

小切手の支払保証はしません。

第16条(印鑑等の届出)

- 当座勘定の取引に使用する印鑑(または署名鑑)は、あらかじめ当行所定の方法により届出てください。

- 代理人により取引をする場合には、本人からその氏名と印鑑(または署名鑑)を前項と同様に届出てください。

第17条(届出事項の変更)

-

手形、小切手、約束手形用紙、小切手用紙、印章を失った場合、または印章、名称、商号、代表者、代理人、住所、電話番号その他届出事項に変更があった場合には、直ちに当行所定の方法により届出てください。

預金口座の開設の際には、法令で定める本人確認等の確認を行います。この確認事項に変更があったときは、直ちに当行所定の方法により届出てください。 - 前項の届出の前に生じた損害については、当行は責任を負いません。

- 第1項による届出事項の変更の届出がなかったために、当行からの通知または送付する書類等が延着しまたは到達しなかった場合には、通常到達すべき時に到達したものとみなします。

第18条(成年後見人等の届出)

- 家庭裁判所の審判により、補助・保佐・後見が開始された場合には、直ちに成年後見人等の氏名その他必要な事項を書面によって届出てください。預金者の成年後見人等について、家庭裁判所の審判により、補助・保佐・後見が開始された場合も同様に届出てください。

- 家庭裁判所の審判により、任意後見監督人の選任がされた場合には、直ちに任意後見人の氏名その他必要な事項を書面によって届出てください。

- 既に補助・保佐・後見開始の審判を受けている場合、または任意後見監督人の選任がなされている場合にも、①および②と同様に届出てください。

- ①から③の届出事項に取消または変更等が生じた場合にも同様に届出てください。

- ①から④の届出の前に生じた損害については、当行は責任を負いません。

第19条(印鑑照合等)

- 払戻請求書、手形、小切手または諸届け書類に使用された印影または署名(電磁的記録により当行に画像として送信されるものを含みます)を、届出の印鑑(または署名鑑)と相当の注意をもって照合し、相違ないものと認めて取扱いましたうえは、その払戻請求書、手形、小切手、諸届け書類につき、偽造、変造、その他の事故があっても、そのために生じた損害については、当行は責任を負いません。

- 手形、小切手として使用された用紙(電磁的記録により当行に画像として送信されるものを含みます)を、相当の注意をもって第10条の交付用紙であると認めて取扱いましたうえは、その用紙につき模造、変造、流用があっても、そのために生じた損害については、前項と同様とします。

- この規定および別に定める手形用法、小切手用法に違反したために生じた損害についても、第1項と同様とします。

第20条(振出日、受取人記載もれの手形、小切手)

- 手形、小切手を振出しまたは為替手形を引受ける場合には、手形要件、小切手要件をできるかぎり記載してください。もし、小切手もしくは確定日払の手形で振出日の記載のないものまたは手形で受取人の記載のないものが呈示されたときはその都度連絡することなく支払うことができるものとします。

- 前項の取扱いによって生じた損害については、当行は責任を負いません。

第21条(線引小切手の取扱い)

- 線引小切手が呈示された場合、その裏面に届出印の押なつ(または届出の署名)があるときは、その持参人に支払うことができるものとします。

- 前項の取扱いをしたため、小切手法第38条第5項の規定による損害が生じても、当行はその責任を負いません。また、当行が第三者にその損害を賠償した場合には、振出人に求償できるものとします。

第22条(自己取引手形等の取扱い)

- 手形行為に取締役会の承認、社員総会の認許その他これに類する手続きを必要とする場合でも、その承認等の有無について調査を行うことなく、支払をすることができます。

- 前項の取扱いによって生じた損害については、当行は責任を負いません。

第23条(利息)

当座預金には利息をつけません。

第24条(残高の報告)

当座勘定の受払または残高の照会があった場合には、当行所定の方法により報告します。

第25条(譲渡、質入れの禁止)

この預金は、譲渡または質入れすることはできません。

第26条(取引等の制限)

- 預金者が当行からの各種確認や資料の提出の依頼に正当な理由なく別途定める期日までに回答しない場合には、払戻し等の預金取引の一部を制限する場合があります。

- 1年以上利用のない預金口座は、払戻し等の預金取引の一部を制限する場合があります。

- 日本国籍を保有せず本邦に居住する預金者は、当行の求めに応じ適法な在留資格・在留期間を保持している旨を当行所定の方法により届け出るものとします。当該預金者が当行に届け出た在留期間が超過した場合、払戻し等の預金取引の一部を制限することができるものとします。

- 当行が別途定める「当行金融サービスに対する濫用防止方針」を踏まえ、第1項の各種確認や資料の提出の依頼に対する預金者の対応、具体的な取引の内容、預金者の説明内容、およびその他の事情を考慮して、当行がマネー・ローンダリング、テロ資金供与、もしくは経済制裁への抵触のおそれがあると判断した場合には、次の取引について制限を行うことができるものとします。

- 不相当に多額または頻繁と認められる現金での入出金取引

- 外国送金、外貨預金、両替取引、貿易取引等外為取引全般

- 当行がマネー・ローンダリング、テロ資金供与、または経済制裁への抵触のリスクが高いと判断した個別の取引

- 第1項から第4項に定めるいずれの取引等の制限についても、預金者から合理的な説明がなされたこと等により、マネー・ローンダリング、テロ資金供与、または経済制裁への抵触のおそれが解消されたと認められる場合、当行は速やかに前4項の取引等の制限を解除します。

第27条(解約)

- この取引は、当事者の一方の都合でいつでも解約することができます。ただし、当行に対する解約の通知は書面によるものとします。

- 次の各号のいずれかに該当した場合には、当行はこの預金取引を停止し、または預金者に通知することによりこの当座勘定を解約することができるものとします。なお、通知により解約する場合、到達のいかんにかかわらず、当行が解約の通知を届出のあった氏名、住所にあてて発信した時に解約されたものとします。

- この当座勘定の名義人が存在しないことが明らかになった場合または当座勘定の名義人の意思によらず開設されたことが明らかになった場合

- この当座勘定の預金者が第25条に違反した場合

- この預金が本邦または外国の法令・規制や公序良俗に反する行為に利用され、またはそのおそれがあると認められる場合

- 法令で定める本人確認等における確認事項、および第26条第1項で定める当行からの通知等による各種確認や提出された資料が偽りである場合

- この預金がマネー・ローンダリング、テロ資金供与、経済制裁に抵触する取引に利用され、またはそのおそれがあると当行が認め、マネー・ローンダリング等防止の観点で当行が預金口座の解約が必要と判断した場合

- 第26条第1項から第3項に定める取引等の制限に係る事象が1年以上に渡って解消されない場合

- 第1号から第6号の疑いがあるにもかかわらず、正当な理由なく当行からの確認に応じない場合

- 前項のほか、次の各号のいずれかに該当し、当行が取引を継続することが不適切である場合には、当行はこの取引を停止し、または解約の通知をすることによりこの当座勘定を解約することができるものとします。通知により解約する場合には到達のいかんにかかわらず、その通知を発信したときに解約されたものとします。なお、この解約によって生じた損害については、当行は責任を負いません。また、この解約により当行に損害が生じたときは、その損害額を支払ってください。

- 当座勘定開設申込時にした表明・確約に関して虚偽の申告をしたことが判明した場合

- 本人が暴力団、暴力団員、暴力団員でなくなった時から5年を経過しない者、暴力団準構成員、暴力団関係企業、総会屋等、社会運動等標ぼうゴロまたは特殊知能暴力集団等、その他これらに準ずる者(以下これら「暴力団員等」という。)に該当し、または次のいずれかに該当することが判明した場合

- 暴力団員等が経営を支配していると認められる関係を有すること

- 暴力団員等が経営に実質的に関与していると認められる関係を有すること

- 自己、自社もしくは第三者の不正の利益を図る目的または第三者に損害を加える目的をもってするなど、不当に暴力団員等を利用していると認められる関係を有すること

- 暴力団員等に対して資金等を供給し、または便宜を供与する等の関与をしていると認められる関係を有すること

- 役員または経営に実質的に関与している者が暴力団員等と社会的に非難されるべき関係を有すること

- 本人が、自らまたは第三者を利用して次のいずれか一にでも該当する行為をした場合

- 暴力的な要求行為

- 法的な責任を超えた不当な要求行為

- 取引に関して、脅迫的な言動をし、または暴力を用いる行為

- 風説を流布し、偽計を用いまたは威力を用いて当行の信用を毀損し、または当行の業務を妨害する行為

- その他AからDに準ずる行為

- 当行が解約の通知を届出の住所にあてて発信した場合に、その通知が延着しまたは到達しなかったときは、通常到達すべきときに到達したものとみなします。

- 手形交換所の取引停止処分を受けたために、当行が解約する場合には、到達のいかんにかかわらず、その通知を発信した時に解約されたものとします。

第28条(取引終了後の処理)

- この取引が終了した場合には、その終了前に振出された約束手形、小切手または引受けられた為替手形であっても、当行はその支払義務を負いません。

- 前項の場合には、未使用の手形用紙、小切手用紙は直ちに当店へ返却するとともに、当座勘定の決済を完了してください。

第29条(手形交換所規則による取扱い)

- この取引については、前各条のほか、関係のある手形交換所の規則に従って処理するものとします。

- 関係のある手形交換所で災害、事変等のやむを得ない事由により緊急措置がとられている場合には、第9条の第1項にかかわらず、呈示期間を経過した手形についても当座勘定から支払うことができるなど、その緊急措置に従って処理するものとします。

- 前項の取扱いによって生じた損害については、当行は責任を負いません。

第30条(民間公益活動を促進するための休眠預金等に係る資金の活用に関する法律について)

この預金について10年を越えて入出金等の異動がなかった場合は、民間公益活動を促進するための休眠預金等に係る資金の活用に関する法律第2条6項の休眠預金等に該当するものとして、この預金にかかる資金は、同法第7条にもとづき預金保険機構に移管されます。休眠預金等に関しては、休眠預金規定が適用されます。

第31条(規定の変更)

- この規定の各条項その他の条件は、金融情勢の状況の変化その他相当の事由があると認められる場合には、当行ウェブサイトへの掲載による公表その他相当の方法で周知することにより、変更できるものとします。

- 前項の変更は、公表等の際に定める適用開始日から適用されるものとします。

以上

(2025年10月1日現在)

休眠預金規定

第1条(休眠預金等活用法に係る最終異動日等)

- 民間公益活動を促進するための休眠預金等に係る資金の活用に関する法律(以下、「休眠預金等活用法」という。)第2条2項に規定する預金等(以下、「預金等」という。)について、休眠預金等活用法における最終異動日等とは、次に掲げる日のうち最も遅い日をいうものとします。

- 当行ウェブサイトに掲げる異動が最後にあった日

- 将来における預金に係る債権の行使が期待される事由として次項で定める事由のある預金については、預金に係る債権の行使が期待される日として次項において定める日

-

当行が預金者に対して休眠預金等活用法第3条第2項の通知を発した日。

ただし、当該通知が預金者に到達した場合または当該通知を発した日から1ヵ月を経過した場合(1ヵ月を経過する日または当行があらかじめ預金保険機構に通知した日のうちいずれか遅い日までに通知が預金者の意思によらないで返送されたときを除く。)に限ります。 - 休眠預金等活用法第2条第2項に定める預金等に該当することとなった日

- 第1項第2号において、将来における預金に係る債権の行使が期待される事由とは、次の各号に掲げる事由のみをいうものとし、預金に係る債権の行使が期待される日とは、当該各号に掲げる事由に応じ、当該各号に定める日とします。

-

預入期間、計算期間または償還期間の定めがあること

当該期間の末日(自動継続扱いの預金にあっては、初回満期日) - 初回の満期日後に次に掲げる事由が生じたこと当該事由が生じた日の属する期間の満期日

- 異動事由(当行ウェブサイトにおいて「異動事由」として掲げる事由をいいます。)

-

当行が休眠預金等活用法第3条第2項に定める事由の通知を発したこと。

ただし、当該通知が預金者等に到達した場合または当該通知を発した日から1ヵ月を経過した場合(1ヵ月を経過する日または当行があらかじめ預金保険機構に通知した日のうちいずれか遅い日までに通知が預金者の意思によらないで返送されたときを除く。)に限ります。

-

法令、法令にもとづく命令もしくは措置または契約により、この預金について支払が停止された場合

当該支払停止が解除された日 -

預金等について、強制執行、仮差押えまたは国税滞納処分の対象となった場合

当該手続が終了した日(納税準備預金、別段預金、定期預金、通知預金、積立預金については異動とならない場合があります。) -

法令または契約にもとづく振込の受入れ、口座振替その他の入出金が予定されていることまたは予定されていたこと(ただし、当行が入出金の予定把握することができるものに限ります。)

当該入出金が行われた日または入出金が行われないことが確定した日 -

総合口座規定にもとづく他の預金について、前各号に掲げる事由が生じたこと

他の預金に係る最終異動日

第2条(複数の預金を組み合わせた商品(総合口座等)に係る預金の最終異動日等)

総合口座取引等における預金のいずれかに将来における債権の行使が期待される事由が生じた場合には、他の預金にも当該事由が生じたものとして取り扱います。

第3条(休眠預金等代替金に関する取扱い)

- 預金等について10年を越えてお取引がない場合、休眠預金等活用法にもとづきこの預金に係る債権は消滅し、預金者等は、預金保険機構に対する休眠預金等代替金債権を有することになります。

- 前項の場合、預金者等は、当行を通じてこの預金に係る休眠預金等代替金債権の支払を請求することができます。この場合において、当行が承諾したときは、預金者は、当行に対して有していた預金債権を取得する方法によって、休眠預金等代替金債権の支払を受けることができます。

- 預金者等は、第1項の場合において、次に掲げる事由が生じたときは、休眠預金等活用法第7条第2項による申出および支払の請求をすることについて、あらかじめ当行に委任します。

- 預金等について、振込、口座振替その他の方法により、第三者からの入金または当行からの入金であって法令または契約に定める義務にもとづくもの(利子の支払に係るものを除きます。)が生じたこと

- 預金等について、手形または小切手の提示その他の第三者による債権の支払の請求が生じたこと(当行が当該支払の請求を把握することができる場合に限ります。)

- 預金等に係る休眠預金等代替金支払請求権に対して強制執行、仮差押えまたは国税滞納処分(その例による処分)が行われたこと

- 預金等に係る休眠預金等代替金の一部の支払が行われたこと

- 当行は、次の各号に掲げる事由を満たす場合に限り、預金者等に代わって第3項による休眠預金等代替金の支払を請求することを約します。

- 当行が預金等に係る休眠預金等代替金について、預金保険機構から支払等業務の委託を受けていること

- 預金等について、第3項第2号に掲げる事由が生じた場合には、当該支払への請求に応じることを目的として預金保険機構に対して休眠預金等代替金の支払を請求すること

- 前項にもとづく取り扱いを行う場合には、預金者等が当行に対して有していた預金債権を取得する方法によって支払うこと

- 本条については、休眠預金等活用法にもとづき預金等に係る債権が消滅したことに伴い、本契約を解約された預金契約についても適用されるものとします。

第4条(通知方法)

法第3条2項の通知方法は、郵送によるほか、電子メールにより取り扱います。

第5条(規定の変更等)

- この規定の各条項その他の条件は、金融情勢その他の状況の変化その他相当の事由があると認められる場合には、当行ホームページへの掲載その他相当の方法で公表することにより、変更できるものとします。

- 前項の変更は、公表の際に定める相当な期間を経過した日から適用されるものとします。

以上

(2018年1月1日現在)

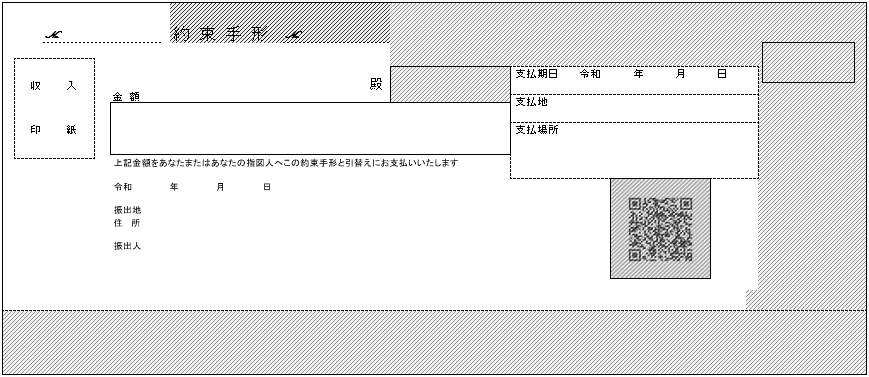

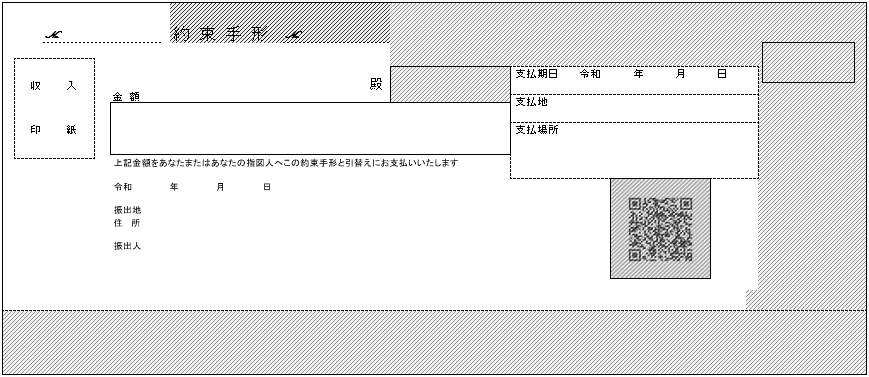

約束手形用法

- この手形用紙は、当店における貴方名義の当座勘定にかぎり使用し、他の当座勘定に使用したり、他人に譲り渡すことはしないでください。

- 手形のお振出しにあたっては、金額、住所、支払期日を明確に記入し、記名なつ印に際しては、当店へお届けのご印章を使用してください。住所の記載があれば振出地の記入は省略することができます。なお、改ざん防止のために消しにくい筆記具を使用してください。

- 振出日、受取人の記載は、手形要件となっておりますから、できるだけ記入してください。

- 金額は所定の金額欄に記入してください。

-

金額をアラビア数字(算用数字、1、2、3…)で記入するときは、チェックライターを使用し、金額の頭には「¥」を、その終わりには「※」、「★」などの終止符号を印字するほか、3桁ごとに「,」を印字してください。

なお、文字による複記はしないでください。 - 金額を文字で記入するときは、文字の間をつめ、下表の文字一覧のとおり改ざんしにくい文字を使用し、金額の頭には「金」を、その終りには「円」を記入してください。また、崩し字は使用せず、楷書で丁寧に記入してください。

- 金額欄には、第2項または第3項に掲げる事項以外の記入は一切行わないでください。特になつ印や金額の複記が金額欄に重なることがないようにしてください。

-

金額を誤記されたときは、訂正しないで新しい手形用紙を使用してください。金額以外の記載事項を訂正するときは、訂正個所にお届け印をなつ印してください。

ただし、訂正の記載やなつ印が、金額欄、銀行名、二次元コード欄に重なることがないようにしてください。 - 手形用紙の右上辺、右辺ならびに下辺(クリアーバンド)などの余白部分(下図斜線部分)は使用しないでください。また、記名なつ印や金額の複記その他の記載が二次元コード欄に重なることがないようにしてください。

- 手形用紙は大切に保管し、万一、紛失、盗難などの事故があったときは、当行所定の用紙によりただちに届出てください。

- 手形用紙は、当行所定の受取書に記名なつ印(お届け印)のうえ請求してください。

- 自署によるお取引の場合は、記名なつ印にかえ自署してください。ただし記載事項の訂正には姓だけをお書きください。

●金額を文字で記入する場合に使用する文字一覧

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

〈その他〉金、円、圓(円の異体字)、億

- お取扱い上の誤り防止等のため、上表以外の異体字、崩し字のご使用はお控えください。

以上

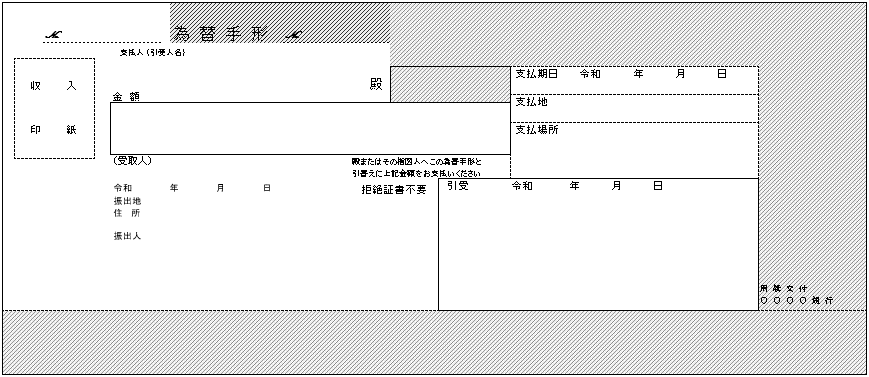

為替手形用法

- この手形用紙を用紙のままで他人に譲り渡すことはしないでください。

- 手形のお振出しにあたっては、支払人(引受人)が金融機関と当座勘定取引があることをできるだけ確めてください。

- 手形のお振出しにあたっては、金額、住所、支払期日などを明確に記入してください。住所の記載があれば振出地の記入は省略することができます。なお、改ざん防止のために消しにくい筆記具を使用してください。

- 振出日、支払人、受取人の記載は手形要件となっておりますから、できるだけ記入してください。

- 金額は所定の金額欄に記入してください。

-

金額をアラビア数字(算用数字、1、2、3……)で記入するときは、チェックライターを使用し、金額の頭には「¥」を、その終わりには「※」、「★」などの終止符号を印字するほか、3桁ごとに「,」を印字してください。

なお、文字による複記はしないでください。 - 金額を文字で記入するときは、文字の間をつめ、下表の文字一覧のとおり改ざんしにくい文字を使用し、金額の頭には「金」を、その終りには「円」を記入してください。また、崩し字は使用せず、楷書で丁寧に記入してください。

- 金額欄には、第2項または第3項に掲げる事項以外の記入は一切行わないでください。特になつ印や金額の複記が金額欄に重なることがないようにしてください。

- 金額を誤記されたときは、訂正しないで新しい手形用紙を使用してください。金額以外の記載事項を訂正するときは、訂正個所にお届け印をなつ印してください。ただし、訂正の記載やなつ印が、金額欄、銀行名に重なることがないようにしてください。

- 当店を支払場所とする手形のお引受けにあたっては、支払地、支払場所などを明確に記入のうえ、記入なつ印には、当店へお届けのご印章を使用してください。

- 手形用紙の右上辺、右辺ならびに下辺(クリアーバンド)などの余白部分(下図斜線部分)は使用しないでください。

- 手形用紙は大切に保管してください。当店を支払場所とする手形について、万一、紛失、盗難などの事故があったときは、当行所定の用紙によりただちに届出てください。

- 手形用紙は、当行所定の受取書に記入なつ印(お届け印)のうえ請求してください。

- 自署によるお取引の場合は、記名なつ印にかえ自署してください。ただし記載事項の訂正には姓だけお書きください。

●金額を文字で記入する場合に使用する文字一覧

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

〈その他〉金、円、圓(円の異体字)、億

- お取扱い上の誤り防止等のため、上表以外の異体字、崩し字のご使用はお控えください。

以上

【一般当座用】小切手用法

- この小切手用紙は、当店における貴方名義の当座勘定にかぎり使用し、他の当座勘定に使用したり、他人に譲り渡すことはしないでください。

- 小切手のお振出しにあたっては、当座勘定の残高を確認してください。なお、先日付の小切手でも呈示をうければ支払うことになりますからご承知おきください。

- 小切手のお振出しにあたっては、金額、振出日などを明確に記入し、記名なつ印に際しては、当店へお届けのご印章を使用してください。なお、改ざん防止のために消しにくい筆記具を使用してください。

- 金額は所定の金額欄に記入してください。

-

金額をアラビア数字(算用数字、1、2、3…)で記入するときは、チェックライターを使用し、金額の頭には「¥」を、その終りには「※」、「★」などの終止符号を印字するほか、3桁ごとに「,」を印字してください。

なお、文字による複記はしないでください。 - 金額を文字で記入するときは、文字の間をつめ、下表の文字一覧のとおり改ざんしにくい文字を使用し、金額の頭には「金」を、その終りには「円」を記入してください。また、崩し字は使用せず、楷書で丁寧に記入してください。

- 金額欄には、第2項または第3項に掲げる事項以外の記入は一切行わないでください。特になつ印や金額の複記が金額欄に重なることがないようにしてください。

-

金額を誤記されたときは、訂正しないで新しい小切手用紙を使用してください。金額以外の記載事項を訂正するときは、訂正個所にお届け印をなつ印してください。

ただし、訂正の記載やなつ印が、金額欄、銀行名、二次元コード欄に重なることがないようにしてください。 -

小切手用紙の下辺余白部分(クリアーバンド)は使用しないでください。

また、記名なつ印や金額の複記が二次元コード欄に重なることがないようにしてください。 - 小切手用紙は大切に保管し、万一、紛失、盗難などの事故があったときは、当行所定の用紙によりただちに届出てください。

- 小切手用紙は、当行所定の受取書に記入なつ印(お届け印)のうえ請求してください。

- 自署だけによるお取引の場合は、記名なつ印にかえ自署してください。ただし記載事項の訂正には姓だけお書きください。

●金額を文字で記入する場合に使用する文字一覧

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

〈その他〉金、円、圓(円の異体字)、億

- お取扱い上の誤り防止等のため、上表以外の異体字、崩し字のご使用はお控えください。

以上

TERMS AND CONDITIONS OF CURRENT ACCOUNTS

Article 1. Refusal of Transaction with Anti-Social Forces

The Current Account shall be made available in case that the Customer does not fall under any of the categories listed in any Items of Article 27, Paragraph 3, and the Bank shall not accept an application for the opening of the Current Account in case that the Customer falls under any of the categories listed in any Items of Article 27, Paragraph 3.

Article 2. Items for Deposit

- In addition to cash, the Bank will accept checks, promissory notes, bills of exchange, interest coupons, postal money orders, dividend warrants, and other immediately collectable instruments (hereinafter referred to as“Instruments”) for deposit in Current Accounts.

- Prior to depositing checks, promissory notes, or bills of exchange, the depositor is required to fill in all blanks and to provide all information which is required by law for the validity of such instruments. The Bank is not obligated to complete any incomplete form.

- Before submitting any Instrument to the Bank for deposit, the depositor must endorse the Instrument and complete all other formalities necessary to render it ready for collection.

- All expenses, if any, relating to the collection of Instruments will be charged to the depositor in accordance with the Bank’s collection fee schedule, which is posted at the Bank’s offices. In the case of handling cash that meets the Bank’s prescribed conditions, such as accepting old banknotes, old coins, and commemorative coins in this Current Account, the Bank’s prescribed handling fees will be charged to the depositor.

Article 3. Receipt of Instruments for Deposit

- The proceeds of any and all Instruments received from the depositor for deposit by the Bank’s office where the depositor’s Current Account is maintained (hereinafter referred to as the“Depository Office”), will not be available for payment before the Bank has ascertained that the Instruments for collection have been settled by verifying that they have not been returned within the prescribed period for returning dishonored Instruments.

- The proceeds of any Instrument received for deposit by and payable at the Depository Office will be made available for payment on the day of receipt of the Instrument, but not until the Depository Office has confirmed settlement of the Instrument.

Article 4. Remittance by Depositor

- The proceeds of any and all Instruments received from the depositor for deposit by the Bank’s office where the depositor’s Current Account is maintained (hereinafter referred to as the“Depository Office”), will not be available for payment before the Bank has ascertained that the Instruments for collection have been settled by verifying that they have not been returned within the prescribed period for returning dishonored Instruments.

- The proceeds of any Instrument received for deposit by and payable at the Depository Office will be made available for payment on the day of receipt of the Instrument, but not until the Depository Office has confirmed settlement of the Instrument.

Article 5. Deposits by a Third Party

- The provisions of Article 3 shall apply mutatis mutandis to Instruments which have been received at the Depository Office from a third party for deposit in the Current Account.

- The provisions of Article 4 shall apply mutatis mutandis to deposits remitted by a third party through another financial institution or one of the Bank’s offices other than the Depository Office.

Article 6. Dishonor of Received Instruments

- The Bank will promptly notify the depositor if an Instrument received for deposit in, or for remittance to, the Current Account as provided for in the preceding three Articles is dishonored and at the same time reverse the relevant entry in the Current Account Ledger. Upon request, the dishonored Instrument will be returned to the depositor at the office where the Instrument was received. If the dishonored Instrument was received from a third party as provided for in Article 5, it will be returned to that third party. However, in a situation in which Article 5, Paragraph 1 applies, the Bank may return the dishonored Instrument through the depositor to the third party that deposited it.

- When the preceding Paragraph applies, the Bank will take procedures to preserve the holder’s rights in respect of a dishonored Instrument only if it has received a written request to do so.

Article 7. Procedure for Face Value Recognition

When receiving or paying checks, promissory notes, or bills of exchange, the Bank will rely on and assume the amount as shown in the place specified for value to be correct, regardless of any other indications that may be shown elsewhere, whether in words or figures.

Article 8. Withdrawal of Deposits

- When withdrawing a deposit, the depositor is required to comply with the Current Account Cash Card Rules, and if the Bank separately agrees, the depositor should submit a Bank specified withdrawal slip stamped with a seal (or signature) filed with the Depository Office to the office specified by the Bank. In addition to the above method, checks may also be used.

- In addition to the procedures for withdrawal mentioned in the preceding paragraph, the Bank may ask the depositor to undertake procedures such as presenting identity verification documents specified by the Bank or the depositor’s current account cash card in order to confirm that the depositor has the justifiable authority to receive withdrawal of the deposits. In such case, the Bank may, as deemed necessary, not withdraw the deposits until such confirmation can be made.

Article 9. Payment of Checks, Promissory Notes and Bills of Exchange

- The Bank is authorized to and will pay, by debiting the Current Account, checks presented for payment and promissory notes or bills of exchange presented for payment within the period prescribed for presentation.

- When making the payment mentioned in the preceding paragraph, the Bank may confirm whether the check, promissory note, or bill of exchange has been drawn (including requesting delivery of a document to that effect).

Article 10. Forms for Checks, Promissory Notes, and Bills of Exchange

- The depositor is required to use the forms provided by the Bank when drawing checks on the Bank or promissory notes payable at the Depository Office.

- When accepting bills of exchange payable at the Depository Office, the depositor is required to ascertain that the forms for such have been provided by financial institutions which are authorized to receive deposits.

- The Bank will not honor any check, promissory note, or bill of exchange which does not comply with Paragraphs 1 and 2 of this Article.

- Please notify the Bank immediately if a check, promissory note, or bill of exchange paid from the Current Account was not issued by you or there is reason to suspect that a check, promissory note, or bill of exchange has been tampered with.

- Requests to return forms for checks, promissory notes, and bills of exchange paid from the Current Account shall not be made after three (3) months have passed from the date of such payment.

- If the period mentioned in the preceding paragraph has passed, and upon your request, the Bank will provide a copy of such check, promissory note, or bill of exchange in accordance with the Bank’s prescribed procedures, unless the deadline for retention of the copy set by the Bank has passed.

Article 11. Payment Limits

- The Bank is not obligated to pay checks, promissory notes, or bills of exchange, etc., presented for payment in excess of the funds available for payment in the Current Account.

- The Bank will not make any partial payments on checks, promissory notes, or bills of exchange.

- Payment for checks, promissory notes, or bills of exchange presented will be made from the funds received for deposit in the Current Account no later than 15:00 hrs. on the day such documents are presented.

Article 12. Choice of Payment

If the total amount of all checks, promissory notes, or bills of exchange, etc., received to be paid on the same business day exceeds the funds available for payment in the Current Account, then the Bank may select, at its sole discretion, on which instruments to make payments.

Article 13. Excessive Drawing

- When the Bank, notwithstanding Article 11, Paragraph 1, has paid at its discretion a check, promissory note, or bill of exchange, etc., in excess of the funds available for payment, the depositor shall reimburse the Bank, immediately upon demand, for payment of the deficiency.

- Damages resulting from the payment of the deficiency mentioned in the preceding Paragraph shall be calculated at the rate of 14% per annum (on a par diem basis based on a 365 day year), pursuant to the method specified by the Bank.

- Any funds received for deposit in the Current Account after the Bank has made a payment as provided for in Paragraph 1 of this Article will be first allocated to reimburse the Bank for payment of the deficiency.

- Should the depositor fail to reimburse the Bank as provided for in Paragraph 1 of this Article, or fail to pay damages as provided for in Paragraph 2 of this Article, the Bank shall be entitled to set off all such claims at any time against any and all accounts or liabilities of the Bank to the depositor regardless of their maturities.

- As long as any liability to reimburse the Bank for payment of a deficiency as provided for in Paragraph 1 of this Article is outstanding, all Instruments received by the Bank from the depositor for deposit in the Current Account shall be deemed to be assigned to the Bank as security for such reimbursement liability.

Article 14. Debits for Bank Charges, etc.

- The Bank may at any time, without using withdrawal slips or checks, deduct funds from the Current Account to cover the interest on loans, discount charges, service fees, guarantee fees, expenses, and other similar charges owed to the Bank by the depositor.

- For automatic payment of various charges, etc., from the Current Account, the depositor must follow the procedures prescribed by the Bank.

- The funds received in the Current Account at or later than the time specified separately by the Bank will not be allocated for automatic payment of various charges on the same day.

Article 15. No Guarantee of Payment

The Bank will not certify or guarantee any checks drawn by the depositor.

Article 16. Filing of Seal Impression, etc.

- A specimen of the seal impression or signature to be used for Current Account transactions must be filed with the Bank in advance on the form provided by the Bank through procedures prescribed by the Bank.

- If Current Account transactions are to be effected by a proxy, the name and a specimen of the seal impression or signature of the proxy must also be filed with the Depository Office by the depositor in the same manner as provided for in the preceding Paragraph :

Article 17. Changes in Matters Filed

-

Immediate notice must be provided in writing to the Bank of loss of any check, promissory note, bill of exchange, blank form of any check or promissory note, or the seal, as well as of any change in respect of any matters filed with the Bank, such as the depositor’s name, trade name, representative, proxy, seal, address or telephone number, through procedures prescribed by the Bank.

When the Bank intends to conclude a contract for opening of the Current Account with a person and/or legal entity who wishes to open the Current Account, the Bank will confirm, pursuant to the provisions of applicable laws and regulations, the identity of the person and/or legal entity for the filing. Immediate notice must be provided, pursuant to the procedure specified by the Bank, to the Bank of any change in respect of the information regarding the identity of the person and/or legal entity filed with the Bank. - The Bank is not responsible for any damages caused prior to the receipt of a written notice as provided for in the preceding Paragraph.

- Any notice or document, etc., sent by the Bank that is received late or fails to reach the depositor due to the depositor’s failure to notify the Depository Office of any changes as required in Paragraph 1 of the Article, shall be deemed to have arrived at the time it normally should have arrived.

Article 18. Filling of guardian for majority (Seinen-Kouken-Nin) etc.

- When guardianship (Kouken), curatorship (Hosa), or assistance (Hojo) is commenced by adjudication of the family court, immediate notice must be provided in writing to the Depository Office of name of guardian for majority (Seinen-Kouken-nin) and other prescribed matter. When guardianship (Kouken), curatorship (Hosa), or assistance (Hojo) is commenced for the depositor by adjudication of the family court, immediate notice must be also provided in writing to the Depository Office of name of guardian for majority (Seinen-Kouken-nin) and other prescribed matter.

- When a supervisor of voluntary guardian (Nin-i-Kouken-Kantoku-nin) is appointed by adjudication of the family court, immediate notice must be provided in writing to the Depository Office of name of voluntary guardian (Nin-i-Kouken-nin) and other prescribed matter.

- When guardianship, curatorship or assistance has been commenced or a supervisor of voluntary guardian has been appointed, immediate notice must be provided as prescribed in the Paragraph 1 and 2 of this Article.

- Immediate notice must be also provided of any change in respect of any matter filed with Depository Office in accordance with the Paragraph 1 through 3 of this Article.

- The Bank is not responsible for any damages caused prior to the receipt of a written notice as provided for in the Paragraph 1 through 4 of this Article.

Article 19. Authenticity of Seal Impression, etc.

- The Bank is not responsible for any damages arising from forgery, alteration, or other wrongful acts in respect of withdrawal slips, checks, promissory notes, bills of exchange, or other items submitted to the Bank, so long as the Bank has verified with reasonable care the seal impression(s) or signature(s) appearing on such items (including seal impression(s) or signature(s) sent as images to the Bank as electromagnetic records) against the specimens filed with the Depository Office.

- The provisions of the preceding Paragraph shall apply mutatis mutandis to all damages that may result from imitation, alteration or misappropriation of check, promissory note, or bill of exchange forms used (including forms sent as images to the Bank as electromagnetic records), so long as the Bank has believed, with reasonable care, that the checks, promissory notes, or bills of exchange presented to it have been made on the proper forms mentioned in Article 10.

- The provisions of Paragraph 1 of this Article shall also apply mutatis mutandis to any damages which result from the violation of these Terms and Conditions of Current Accounts (hereinafter referred to as “the Terms and Conditions”), or any other directions issued by the Bank in regard to the use of Check, promissory note, and bill of exchange forms.

Article 20. Checks, etc., with Blanks

- In drawing checks, promissory notes, or bills of exchange, or in accepting bills of exchange, the depositor is required to fill in all blanks as completely as possible, as required by law for the validity of such instruments. Notwithstanding any omissions, the Bank may pay without notifying the depositor:

- checks, promissory notes, or bills of exchange payable on a fixed date which lack the drawing date ; or

- promissory notes or bills of exchange which lack the payee’s name.

- The Bank is not responsible for any damages that may result from any actions taken in accordance with the preceding Paragraph.

Article 21. Crossed Checks

- The Bank may pay the bearer of a crossed check that is presented for payment which bears on its reverse side the depositor’s seal impression or signature as filed with the Depository Office.

- The Bank is not responsible for any damages covered by Article 38, Paragraph 5 of the Law on Cheques of Japan which arise from any actions taken in accordance with the preceding Paragraph. If, however, as a result of any such action the Bank is compelled to pay damages to a third party, the Bank shall be entitled to reimbursement from the depositor.

Article 22. Inquiry Waived

- The Bank may pay any promissory note or bill of exchange without inquiring as to whether any necessary approval has been received, even if any act related to the promissory note or bill of exchange requires the approval of a board of directors or meeting of shareholders, or some other procedures of a similar type.

- The Bank is not responsible for any damages that may result from any actions taken in accordance with the preceding Paragraph.

Article 23. Interest

The Bank will not pay any interest on credit balances in the Current Account.

Article 24. Information on Balances

Upon request, the Bank will furnish the depositor with information on entries in or the balance of the Current Account in accordance with the procedures specified by the Bank.

Article 25. Prohibition of Transfer or Pledge

The depositor may not transfer or pledge the deposit in the Current Account.

Article 26. Restrictions of Transactions under the Current Account, etc.

- If the depositor does not respond to various kinds of confirmation or a request for document submission from the Bank by the time separately specified by the Bank without justifiable reason, the Bank may restrict some transactions under the Current Account, such as withdrawals.

- If the Current Account is not used for over one (1) year, the Bank may restrict some transactions under the Current Account, such as withdrawals.

- Upon request from the Bank, the depositor who resides in Japan without Japanese nationality shall report to the Bank pursuant to the method specified by the Bank that the depositor has a valid status of residence and period of stay. If the permitted period of stay filed with the Bank expires, the Bank shall be able to restrict some transactions under the Current Account, such as withdrawals.

- If the Bank determines that the depositor poses the risk of money laundering, terrorist financing or a violation of sanctions, after taking into account the depositor’s action in response to confirmation on matters regarding the identity or a request for document submission as set forth in Paragraph 1 of this Article, specific transaction details, explanations provided by the depositor and other circumstances, in light of the “BTMU Financial Service Anti-Abuse Policy” separately set forth by the Bank, the Bank shall be able to restrict the following account transactions.

- Unreasonably high-value or frequent cash transactions for deposits and withdrawals

- Overall foreign exchange transactions, such as cross-border funds transfers, foreign currency deposits, money exchange transactions and trade transactions

- Specific transactions that the Bank determined pose high risk of money laundering and terrorist financing and a violation of sanctions

- Notwithstanding restrictions of transactions under the Current Account, etc. set forth in Paragraphs 1 through 4 of this Article, if a concern over money laundering, terrorist financing or a violation of sanctions is confirmed to be addressed by the depositor’s reasonable explanation or other means, the Bank may immediately lift restrictions of transactions under the Current Account listed in the preceding four (4) Paragraphs.

Article 27. Termination

- The Current Account may be terminated at any time at the discretion of either party. Notice of termination by the Customer shall be in writing.

- If the Current Account falls under any of the categories in any of the following items, the Bank may suspend transactions under the Current Account, or after serving the notice to the Customer, terminate the Current Account. If the Bank terminates the Current Account with the notice, the Current Account shall be deemed to have been terminated when the Bank dispatches the termination notice to the Customer’s name and address filed by the Customer with the Bank, regardless of the delivery status of the notice.

- It becomes clear that the Current Account holder does not exist; or that the Current Account was opened without the intention of the Current Account holder

- The depositor of the Current Account violates Article 25 of the Terms and Conditions.

- The deposit in the Current Account is utilized or at risk of being utilized for an act that violates laws and regulations or the public policy of decency in Japan and overseas

- The information confirmed in the process of customer identification set forth by laws, as well as the information confirmed and documents submitted in response to a notice from the Bank or other requests set forth in Paragraph 1 of Article 26 of the Terms and Conditions are false

- The Bank confirms that the deposit is utilized or at risk of being utilized for money laundering, terrorist financing or a transaction that violates sanctions, thereby determining that the Bank must terminate the Current Account to prevent these activities

- Any of the conditions relating to restrictions of transactions under the Current Account, etc. set forth in Paragraphs 1 through 3 of Article 26 of the Terms and Conditions are not resolved for over one (1) year

- The Customer does not respond to confirmation from the Bank without justifiable reason despite the fact that the customer is suspected of falling under any of the categories in items i through vi of this paragraph

- In addition to the circumstances set out in the preceding Paragraph, if the Customer falls under any of the categories in any of the following Items and if the Bank determines it inappropriate for the Bank to continue transactions with the Customer, the Bank may suspend transactions under the Current Account or, after serving the notice to the Customer, terminate the Current Account. The termination of the Current Account is valid at the point of which the Bank dispatches the notice even if the notice does not reach the Customer. The Bank shall not be liable for any damages incurred by the Customer, but the Customer shall be liable for the damages incurred by the Bank, due to such termination.

- In case that the representatives and covenants made by the Customer at the time of application for the opening of the Current Account have proved to be false

- The Customer does not, and shall not in the future, fall under any of the organized crime syndicate, its member, its ex-member who left the syndicate as recent as less than five (5) years ago, quasi-member of any such syndicate, entity affiliated with any such syndicate, sokaiya corporate racketeer, blackmailer camouflaged as social movement activist or organized crime syndicate specialized in intellectual crimes, and any entity or individual similar to any of the above (collectively, “Member, etc. of Criminal Syndicate”), nor fall under any of the following:

- for the Customer to have a relationship in which its business is deemed to be controlled by the Member, etc. of Criminal Syndicate

- for the Customer to have a relationship in which it is deemed to involve the Member, etc. of Criminal Syndicate in the management of the Customer’s business in substance

- for the Customer to have a relationship in which it is deemed that the Customer utilizes the Member, etc. of Criminal Syndicate unlawfully such as to implement its own unlawful interest of, or to inflict damages to, any third party

- for the Customer to have a relationship which it is deemed that it is affiliated with the Member, etc. of Criminal Syndicate by way of provision of fund or other interests

- for an officer or other person engaged in substance in the management of business of the Customer to have a socially reproachful relationship with the Member, etc. of Criminal Syndicate

- In case that the Customer, by itself or by utilizing any third party, commits any of the following acts:

- to make a threatening demand

- to make an unlawful demand beyond

- to utilize a threatening speech or behavior or illegal force in relation with any transaction

- to injure the reputation or interfere with the business, of the Bank by distributing a false rumor or through fraudulent means or unlawful influence

- to implement an act similar to any of the acts stipulated in A to D above.

- If a termination notice dispatched by the Bank to the Customer at its address as filed with the Bank cannot be delivered or delivery is delayed, such notice shall be deemed to have arrived at the time it normally should have arrived.

- If the Bank terminates the Current Account in accordance with the rules and regulations of a Clearing House demanding the suspension of transactions with the Customer that termination shall take effect immediately upon dispatch of the Bank’s termination notice, regardless of whether the notice reaches the Customer.

Article 28. Post-Termination Procedure

- Once the Current Account has been terminated, the Bank is not responsible for payment of checks or promissory notes drawn by the depositor or bills of exchange accepted by the depositor prior to the termination.

- Once the Current Account has been terminated, the depositor shall immediately return all unused check, promissory note, and bill of exchange forms to the Depository Office, and at the same time settle the Current Account.

Article 29. Clearing House Rules

- In addition to the terms of the Terms and Conditions, Current Account transactions are also subject to the rules and regulations of the applicable Clearing House.

- When the applicable Clearing House implements emergency measures due to unavoidable circumstances such as natural disasters or other local/ national emergencies, then the Bank may take appropriate actions in accordance with these measures, such as paying promissory notes or bills of exchange presented for payment after the prescribed period for presentation has elapsed notwithstanding Article 9, Paragraph 1, by debiting the Current Account.

- The Bank is not responsible for any damages that may result from any actions taken in accordance with the preceding Paragraph.

Article 30. The Act on Utilization of Funds Related to Dormant Deposits to Promote Public Interest Activities by the Private Sector

If there is no account activity such as deposits and withdrawals for ten (10) years or more, such funds shall be fall under “dormant deposits” set forth in Paragraph six (6) of Article 2 of the Act on Utilization of Funds Related to Dormant Deposits to Promote Public Interest Activities by the Private Sector, and the funds in such account shall be transferred to the Deposit Insurance Corporation of Japan pursuant to Article 7 of the Act. Rules on Dormant Deposits apply to dormant deposits.

Article 31. Changes to Rules

- If changes occur to the financial situation or other circumstances, or other reasonable circumstances are acknowledged, the provisions of these Rules or other terms may be changed by announcing changes through publishing on the Bank’s website or publicizing changes by another suitable method.

- The changes set forth in the preceding paragraph shall apply from the date of time established when announcing changes. (This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Current Account Regulations shall be interpreted in accordance with the Japanese original.)

END

(Current as of October 1,2025)

Rules on Dormant Deposits

Article 1. Final Account Activity Date Relating to the Act on the Utilization of Dormant Deposits

- With regard to deposits, etc. (hereinafter referred to as “Deposits, etc.”) provided for in Paragraph (2) of Article 2 of the Act on the Utilization of Funds Relating to Dormant Deposits to Promote Public Interest Activities by the Private Sector (hereinafter referred to as the “Act on the Utilization of Dormant Deposits”), the most recent account activity date, etc. as used in the Act on the Utilization of Dormant Deposits shall be the most recent of the dates stated below:

- The date of the final account activity as stated on the bank’s website

- For deposits involving any circumstances prescribed in the next paragraph as circumstances with which the future enforcement of claims for those deposits is expected, the date prescribed in the following paragraph as the date on which the exercising of claims relating to deposits is expected

-

The date on which the Bank issued the depositor with a notice informing of the matters set forth in Paragraph (2) of Article 3 of the Act on the Utilization of Dormant Deposits

Limited to cases in which the notice has reached the depositor or cases in which one month has passed since the date of issuing the notice (excluding cases in which a notice is returned through no intention of the depositor by the latest of either the date after one month has passed or the date the bank preliminarily notified the Deposit Insurance Corporation of Japan) . - The date on which falling under Deposits, etc. prescribed in Paragraph (2) of Article 2 of the Act on the Utilization of Dormant Deposits

- Circumstances with which the future enforcement of claims for those deposits in Item 2) of Paragraph 1 means only those circumstances stated in each of the following items, and the date on which the exercising of claims relating to deposits is expected shall depend on the circumstances stated in each applicable item, and shall be the date prescribed in each applicable item.

- When there are deposit period, calculation period, or redemption period provisions Last day of such period (first maturity date for deposits that continue automatically)

-

When circumstances stated below occur after the first maturity date

Maturity date for the period that includes the date on which such circumstances arose

- Account activity circumstances (meaning circumstances stated as being “account activity circumstances” on the Bank’s website)

- The Bank issues a notice informing of the circumstances prescribed in Paragraph (2) of Article 3 of the Act on the Utilization of Dormant Deposits Limited to cases in which the notice has reached the depositor or cases in which one month has passed since the date of issuing the notice (excluding cases in which a notice is returned through no intention of the depositor by the latest of either the date after one month has passed or the date the bank preliminarily notified the Deposit Insurance Corporation of Japan).

- If payments relating to the deposits have been suspended due to laws and regulations, orders or measures pursuant to laws and regulations, or agreements – the date on which such suspension of payments is cancelled

-

If subject to compulsory execution, provisional seizure, or collection of delinquent national taxes with respect to Deposits, etc.

Date on which such proceedings close (deposits earmarked for taxes, separate deposits, deposits at notice, and cumulative deposits may not be considered account activity) - When expecting or were expecting to receive remittances, make transfers, or other deposits or withdrawals based on laws and regulations or agreements (limited to when the Bank is able to grasp anticipated deposits or withdrawals) Date on which the deposit or withdrawal occurred or date on which a decision is made not to make deposits or withdrawals

-

When circumstances stated in each of the preceding items have arisen withregard to other deposits pursuant to Rules on Integrated Accounts

Date of final account activity relating to other deposits

Article 2. Final Account Activity Date for Deposits Relating to Financial Instruments Made Up of Multiple Deposits (integrated accounts, etc.)

If circumstances have arisen with which any future enforcement of claims for those deposits is expected for deposits in integrated account transactions, etc., handling shall be as if such circumstances have also arisen for other deposits.

Article 3. Handling of Alternative Funds Such as Dormant Deposits, etc.

- If there are no transactions concerning Deposits, etc. for more than ten (10) years, claims to such deposits shall become extinct pursuant to the Act on the Utilization of Dormant Deposits, and depositors, etc. shall subsequently hold claims for substitute money for dormant deposits with respect to the Deposit Insurance Corporation of Japan.

- In cases set forth in the preceding paragraph, depositors, etc. may request payment of claims for substitute money for dormant deposits in relation to such funds via the Bank. In such case, when the Bank approves, depositors may receive payment of substitute money for dormant deposits by acquiring deposit claims held from the Bank.

- When circumstances stated below have arisen in the case set forth in paragraph 1, depositors, etc. shall commission the Bank in advance to make allegations and demand payments in accordance with Paragraph (2) of Article 7 of the Act on the Utilization of Dormant Deposits.

- When deposits are made by a third party or a deposit is made by the Bank by transfer, deposit or some other method with respect to Deposits, etc. and circumstances arise based on obligations prescribed in laws and regulations or agreements (excluding circumstances relating to interest payments)

- When bills or checks are presented or other demands for payment of claims have been made by third parties with respect to Deposits, etc. (limited to when the Bank is able to grasp such payment demands)

- When compulsory execution, provisional seizure, or collection of delinquent national taxes has occurred with regard to the right to claim payment of substitute money for dormant deposits with respect to Deposits, etc.

- When partial payment of substitute money for dormant deposits is made with respect to Deposits, etc.

- The Bank promises to demand payment of substitute money for dormant deposits in accordance with paragraph 3 on behalf of depositors, etc. only when the circumstances stated in each of the following items have been met.

- When the Bank is entrusted with payment operations by the Deposit Insurance Corporation of Japan relating to substitute money for dormant deposits with respect to Deposits, etc.

- If circumstances stated in item 2 of paragraph 3 have arisen with regard to Deposits, etc., when demanding payment of substitute money for dormant deposits from the Deposit Insurance Corporation of Japan with the aim of responding to demands for such payment

- If undertaking handling based on the preceding paragraph, when depositors, etc. make payments by acquiring deposit claims held from the Bank

- Following the extinction of claims for Deposits, etc. pursuant to the Act on the Utilization of Dormant Deposits with regard to this Article, this Agreement shall also apply to terminated deposit agreements

Article 4. Notification Method

The notification method set forth in Paragraph (2) of Article 3 of the Act shall be by post or by email.

Article 5. Changes to Rules

- If changes occur to the financial situation or other circumstances or other reasonable circumstances are acknowledged, the provisions of these Rules or other terms may be changed by posting changes on the Bank’s website or announcing changing by another suitable method.

- The changes set forth in the preceding paragraph shall apply from the date of expiration of the reasonable period of time established when announcing changes.

END

(Current as of January 1, 2018)

(Current as of January 1, 2018)

DIRECTIONS FOR USE OF BLANK PROMISSORY NOTE FORMS

- These blank promissory note forms can be used only for drawing promissory notes payable at the Depository Office at which you maintain a current account in your name. These forms cannot be used for any other current account or transferred to any other person.

- In drawing a promissory note, the amount, the address and the due date should be clearly written. When you affix your name and seal thereto, please use the seal the impression of which has been filed with the Depository Office in advance (hereinafter referred to as the “filed seal”. If the address is entered, the place of drawing may be dispensed with. In order to prevent alteration, please write in ink or other non-erasable substance.

- Please fill in the date of drawing and the payee since these are legal requirements.

- The amount must be entered in the space in the promissory note form specified for that purpose.

- When an amount is entered in Arabic figures, please use a check writer and print the mark “¥” immediately before the amount, print a mark such as ※ or ★ immediately after the amount, and print a “,” every three digits. Please do not restate the amount in words.

- When an amount is entered in words, please use letters listed in the table below which cannot be easily altered, without leaving space between the letters. Please enter the word “Yen” immediately before the amount and the word “only” immediately after the amount. Please fill in the form carefully using block capitals rather than cursive writing.

- Please do not make any entries in the amount section other than those listed in paragraphs (2) or (3). In particular, please ensure that signatures, seals and duplicate indications of the amount do not overlap the amount section.

-

When an incorrect amount is entered in a promissory note form, please use a new form instead of correcting the original form. When correction of any entry other than the amount is desired, please affix the filed seal to confirm the correction.

Please ensure that corrections, signatures and seals do not overlap the amount section, bank name or two-dimensional code section. -

Please do not make entries in the blank spaces marked by oblique lines as illustrated below, such as the upper right portion, right portion, and the clear band at the bottom of the blank promissory note form.

Please ensure that signatures, seals, duplicate indications of the amount, and other markings do not overlap the two-dimensional code section. - The blank promissory note forms should be kept with due care. In the event any blank forms are lost, stolen or misplaced, please immediately notify the Depository Office on the form provided by the Bank.

- New blank promissory note forms are available upon submitting the receipt form prescribed by the Bank with the name and filed seal duly affixed.

-

When the use of a signature is desired for these transactions, please use the signature in place of the name and seal. For correction of entries, the surname should be signed to confirm the correction.

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Current Account Regulations shall be interpreted in accordance with the Japanese original.)

● List of letters to use when entering the amount

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

Other acceptable letters: 金, 円, 圓 (alternative to 円), 億

- To prevent handling errors, please do not use any other variants or cursive letters.

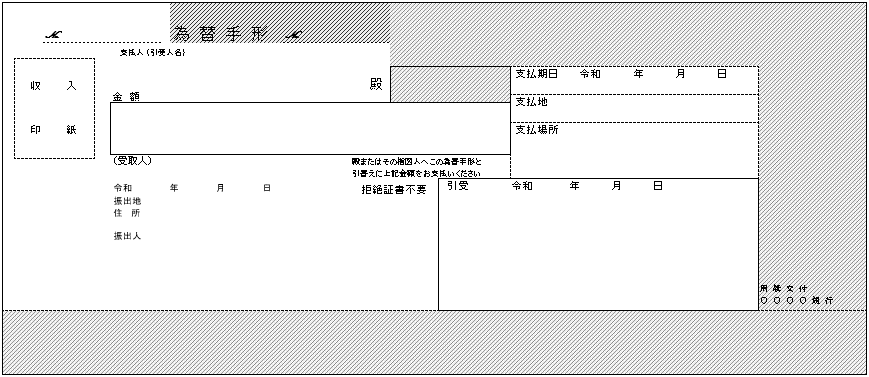

DIRECTIONS FOR USE OF BLANK BILL OF EXCHANGE FORMS

- These blank bill of exchange forms cannot be transferred to any other person.

- In drawing a bill of exchange, please confirm to the extent possible that the payer (acceptor) maintains a current account with a financial institution.

- In drawing a bill of exchange, the amount, the address, the due date, etc., should be clearly written. If the address is entered, the place of drawing may be dispensed with. In order to prevent alteration, please write in ink or other non-erasable substance.

- Please fill in the date of drawing, the payer, and the payee since these are legal requirements.

- The amount must be entered in the space in the bill of exchange form specified for that purpose.

-

When an amount is entered in Arabic figures, please use a check writer and print the mark “¥” immediately before the amount, print a mark such as ※ or ★ immediately after the amount, and print a “,” every three digits.

Please do not restate the amount in words. - When an amount is entered in words, please use letters listed in the table below which cannot be easily altered, without leaving space between the letters. Please enter the word “Yen” immediately before the amount and the word “only” immediately after the amount. Please fill in the form carefully using block capitals rather than cursive writing.

- Please do not make any entries in the amount section other than those listed in paragraphs (2) or (3). In particular, please ensure that signatures, seals and duplicate indications of the amount do not overlap the amount section.

-

When an incorrect amount is entered in a bill of exchange form, please use a new form instead of correcting the original form.

When correction of any entry other than the amount is desired, please affix the seal the impression of which has been filed with the Depository Office (hereinafter referred to as the “filed seal”) to confirm the correction.

Please ensure that corrections, signatures and seals do not overlap the amount section or bank name. - In accepting a bill of exchange which is payable at the Depository Office, please clearly state the place and location of payment, etc., and affix the filed seal.

- Please do not make entries in the blank spaces marked by oblique lines as illustrated below, such as the upper right portion, right portion and the clear band at the bottom of the blank bill of exchange form.

- The blank bill of exchange forms should be kept with due care. In the event any bill of exchange payable at the Depository Office is lost, stolen or misplaced, please immediately notify the Depository Office on the form provided by the Bank.

- New blank bill of exchange forms are available upon submitting the receipt form prescribed by the Bank with the name and filed seal duly affixed.

-

When the use of a signature is desired for these transactions, please use the signature in place of the name and seal. For correction of entries, the surname should be signed to confirm the correction.

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Current Account Regulations shall be interpreted in accordance with the Japanese original.)

● List of letters to use when entering the amount

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

Other acceptable letters: 金, 円, 圓 (alternative to 円), 億

- To prevent handling errors, please do not use any other variants or cursive letters.

(For General Current Account)

DIRECTIONS FOR USE OF BLANK CHECK FORMS

- These blank check forms can be used only for drawing on the Depository Office at which you maintain a current account in your name. These forms cannot be used for any other current account or transferred to any other person.

- Please confirm the balance of your current account when drawing checks. Also please note that the Bank will pay even a post-dated check if presented for payment.

- In drawing a check, the amount, the date of drawing, etc., should be clearly written. When the name and seal is affixed thereto, please use the seal the impression of which has been filed with the Depository Office in advance (hereinafter referred to as the “filed seal”). In order to prevent alteration, please write in ink or other nonerasable substance.

- The amount must be entered in the space in the check form specified for that purpose.

-

When an amount is entered in Arabic figures, please use a check writer and print the mark “¥” immediately before the amount, print a mark such as ※ or ★ immediately after the amount, and print a “,” every three digits.

Please do not restate the amount in words. -

When an amount is entered in words, please use letters listed in the table below which cannot be easily altered, without leaving space between the letters.

Please enter the word “Yen” immediately before the amount and the word “only” immediately after the amount. Please fill in the form carefully using block capitals rather than cursive writing. - Please do not make any entries in the amount section other than those listed in paragraphs (2) or (3). In particular, please ensure that signatures, seals and duplicate indications of the amount do not overlap the amount section.

-

When an incorrect amount is entered in a check form, please use a new form instead of correcting the original form. When correction of any entry other than the amount is desired, please affix the filed seal to confirm the correction.

Please ensure that corrections, signatures and seals do not overlap the amount section, bank name or two-dimensional code section. -

Please do not make entries in the clear band at the bottom of the blank check form.

Please ensure that signatures, seals and duplicate indications of the amount do not overlap the two-dimensional code section. - The blank check forms should be kept with due care. In the event any blank check forms are lost, stolen or misplaced, please immediately notify the Depository Office on the form provided by the Bank.

- New blank forms are available upon submitting the receipt form prescribed by the Bank with the name and filed seal duly affixed.

-

When the use of a signature only is desired for these transactions, please use the signature in place of the name and seal. For correction of entries, the surname should be signed to confirm the correction.

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Terms and Conditions of Current Accounts shall be interpreted in accordance with the Japanese original.)

● List of letters to use when entering the amount

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

Other acceptable letters: 金, 円, 圓 (alternative to 円), 億

- To prevent handling errors, please do not use any other variants or cursive letters.