TERMS AND CONDITIONS OF CURRENT ACCOUNTS (For Use of Personal Accounts)

Article 1. Refusal of Transaction with Anti-Social Forces

The Current Account shall be made available in case that the Customer does not fall under any of the categories listed in any Items of Article 27, Paragraph 3, and the Bank shall not accept an application for the opening of the Current Account in case that the Customer falls under any of the categories listed in any Items of Article 27, Paragraph 3.

Article 2. Items for Deposit

- In addition to cash, the Bank will accept checks, promissory notes, bills of exchange, interest coupons, postal money orders, dividend warrants, and other immediately collectable instruments (hereinafter referred to as “Instruments”) for deposit in Current Accounts.

- Prior to depositing checks, promissory notes, or bills of exchange, the depositor is required to fill in all blanks and to provide all information which is required by law for the validity of such instruments. The Bank is not obligated to complete any incomplete form.

- Before submitting any Instrument to the Bank for deposit, the depositor must endorse the Instrument and complete all other formalities necessary to render it ready for collection.

- All expenses, if any, relating to the collection of Instruments will be charged to the depositor in accordance with the Bank’s collection fee schedule, which is posted at the Bank’s offices. In the case of handling cash that meets the Bank’s prescribed conditions, such as accepting old banknotes, old coins, and commemorative coins in this Current Account, the Bank’s prescribed handling fees will be charged to the depositor.

Article 3. Receipt of Instruments for Deposit

- The proceeds of any and all Instruments received from the depositor for deposit by the Bank’s office where the depositor’s Current Account is maintained (hereinafter referred to as the “Depository Office”), will not be available for payment before the Bank has ascertained that the Instruments for collection have been settled by verifying that they have not been returned within the prescribed period for return- ing dishonored Instruments.

- The proceeds of any Instrument received for deposit by and payable at the Depository Office will be made available for payment on the day of receipt of the Instrument, but not until the Depository Office has confirmed settlement of the Instrument.

Article 4. Remittance by Depositor

- The proceeds of any remittance to the Current Account made by the depositor through another financial institution or one of the Bank’s offices other than the Depository Office, will not be available for payment before they have been credited to the Bank’s Current Account Ledger. However, the proceeds of such a remittance made in the form of an Instrument will not be available for payment until the Bank has confirmed settlement of the Instrument.

- A transfer credited to the Current Account will be reversed if the Bank receives a notice of cancellation for reason of erroneous transmittal of the notice of transfer, e.g., duplicate transmittal, from the financial institution that transmitted the notice of transfer.

Article 5. Deposits by a Third Party

- The provisions of Article 3 shall apply mutatis mutandis to Instruments which have been received at the Depository Office from a third party for deposit in the Current Account.

- The provisions of Article 4 shall apply mutatis mutandis to deposits remitted by a third party through another financial institution or one of the Bank’s offices other than the Depository Office.

Article 6. Dishonor of Received Instruments

- The Bank will promptly notify the depositor if an Instrument received for deposit in, or for remittance to, the Current Account as provided for in the preceding three Articles is dishonored and at the same time reverse the relevant entry in the Current Account Ledger. Upon request, the dishonored Instrument will be returned to the depositor at the office where the Instrument was received. If the dishonored In- strument was received from a third party as provided for in Article 5, it will be returned to that third party. However, in a situation in which Article 5, Paragraph 1 applies, the Bank may return the dishonored Instrument through the depositor to the third party that deposited it.

- When the preceding Paragraph applies, the Bank will take procedures to preserve the holder’s rights in respect of a dishonored Instrument only if it has received a written request to do so.

Article 7. Procedure for Face Value Recognition

When receiving or paying checks, promissory notes, or bills of exchange, the Bank will rely on and assume the amount as shown in the place specified for value to be correct, regardless of any other indications that may be shown elsewhere, whether in words or figures.

Article 8. Withdrawal of Deposits

- When withdrawing a deposit, the depositor is required to comply with the Current Account Cash Card Rules, and if the Bank separately agrees, the depositor should submit a Bank specified withdrawal slip stamped with a seal (or signature) filed with the Depository Office to the office specified by the Bank. In addition to the above method, the depositor or his or her authorized agent of the depositor may also use a check drawn in his or her own name.

- In addition to the procedures for withdrawal mentioned in the preceding paragraph, the Bank may ask the depositor to undertake procedures such as presenting identity verification documents specified by the Bank or the depositor’s current account cash card in order to confirm that the depositor has the justifiable authority to receive withdrawal of the deposits. In such case, the Bank may, as deemed necessary, not withdraw the deposits until such confirmation can be made.

Article 9. Payment of Checks, Promissory Notes and Bills of Exchange

- The Bank is authorized to and will pay, by debiting the Current Account, checks presented for payment and promissory notes or bills of exchange presented for payment within the period prescribed for presentation. Checks and promissory notes drawn and bills of exchange accepted by the authorized agent of the depositor by its own name will also be paid from this account.

- When making the payment mentioned in the preceding paragraph, the Bank may confirm whether the check, promissory note, or bill of exchange has been drawn (including requesting delivery of a document to that effect).

- The depositor or the agent may file a notice to revoke the authorization to pay a check, promissory note, or bill of exchange, irrespective of whether such instrument has been drawn or accepted by the depositor or the agent; provided that such notice must be made in writing.

Article 10. Forms for Checks, Promissory Notes, and Bills of Exchange

- The depositor is required to use the forms provided by the Bank when drawing checks on the Bank or promissory notes payable at the Depository Office.

- When accepting bills of exchange payable at the Depository Office, the depositor is required to ascertain that the forms for such have been provided by financial institutions which are authorized to receive deposits.

- The Bank will not honor any check, promissory note, or bill of exchange which does not comply with Paragraphs 1 and 2 of this Article.

- Please notify the Bank immediately if a check, promissory note, or bill of exchange paid from the Current Account was not issued by you or there is reason to suspect that a check, promissory note, or bill of exchange has been tampered with.

- Requests to return forms for checks, promissory notes, and bills of exchange paid from the Current Account shall not be made after three (3) months have passed from the date of such payment.

- If the period mentioned in the preceding paragraph has passed, and upon your request, the Bank will provide a copy of such check, promissory note, or bill of exchange in accordance with the Bank’s prescribed procedures, unless the deadline for retention of the copy set by the Bank has passed.

Article 11. Payment Limits

- The Bank is not obligated to pay checks, promissory notes, or bills of exchange, etc., presented for payment in excess of the funds available for payment in the Current Account.

- The Bank will not make any partial payments on checks, promissory notes, or bills of exchange.

- Payments for checks, promissory notes, or bills of exchange presented will be made from the funds received for deposit in the Current Account no later than 15:00 hrs. on the day such documents are presented.

Article 12. Choice of Payment

If the total amount of all checks, promissory notes, or bills of exchange, etc., received to be paid on the same business day exceeds the funds available for payment in the Current Account, then the Bank may select, at its sole discretion, on which instruments to make payments.

Article 13. Excessive Drawing

- When the Bank, notwithstanding Article 11, Paragraph 1, has paid at its discretion a check, promissory note, or bill of exchange, etc., in excess of the funds available for payment, the depositor shall reimburse the Bank, immediately upon demand, for payment of the deficiency.

- Damages resulting from the payment of the deficiency mentioned in the preceding Paragraph shall be calculated at the rate of 14 % per annum(on a per diem basis based on a 365 day year), pursuant to the method specified by the Bank.

- Any funds received for deposit in the Current Account after the Bank has made a payment as provided for in Paragraph 1 of this Article will be first allocated to reimburse the Bank for payment of the deficiency.

- Should the depositor fail to reimburse the Bank as provided for in Paragraph 1 of this Article, or fail to pay damages as provided for in Paragraph 2 of this Article, the Bank shall be entitled to set off all such claims at any time against any and all accounts or liabilities of the Bank to the depositor regardless of their maturities.

- As long as any liability to reimburse the Bank for payment of a deficiency as provided for in Paragraph 1 of this Article is outstanding, all Instruments received by the Bank from the depositor for deposit in the Current Account shall be deemed to be assigned to the Bank as security for such reimbursement liability.

Article 14. Debits for Bank Charges, etc.

- The Bank may at any time, without using withdrawal slips or checks, deduct funds from the Current Account to cover the interest on loans, service fees, expenses, and other similar charges owed to the Bank by the depositor.

- For automatic payment of various charges, etc., from the Current Account, the depositor must follow the procedures prescribed by the Bank.

- The funds received in the Current Account at or later than the time specified separately by the Bank will not be allocated for automatic payment of various charges on the same day.

Article 15. No Guarantee of Payment

The Bank will not certify or guarantee any checks drawn by the depositor.

Article 16. Filing of Specimen Signature

- Checks, promissory notes, bills of exchange, and other documents submitted to the Bank must be signed by the depositor himself, and the specimen of his signature must be filed with the Bank in advance on the form provided by the Bank through procedures prescribed by the Bank.

- If Current Account transactions are to be effected by an agent, the name and a specimen signature of the agent must also be filed with the Depository Office by the depositor in the same manner as provided for in the preceding Paragraph.

Article 17. Changes in Matters Filed

- Immediate notice must be provided in writing to the Bank of loss of any check, promissory note, bill of exchange, blank form of any check or promissory note, as well as of any change in respect of any matters filed with the Bank, such as the depositor’s name, agent, address or telephone number, through procedures prescribed by the Bank.When the Bank intends to conclude a contract for opening of the Current Account with a person and/or legal entity who wishes to open the Current Account, the Bank will confirm, pursuant to the provisions of applicable laws and regulations, the identity of the person and/or legal entity for the filing. Immediate notice must be provided, pursuant to the procedure specified by the Bank, to the Bank of any change in respect of the information regarding the identity of the person and/or legal entity filed with the Bank.

- The Bank is not responsible for any damages caused prior to the receipt of a written notice as provided for in the Preceding paragraph.

- Any notice or document, etc., sent by the Bank that is received late or fails to reach the depositor due to the depositor’s failure to notify the Depository Office of any changes as required in Paragraph 1 of this Article, shall be deemed to have arrived at the time it normally should have arrived.

Article 18. Filling of guardian for majority(Seinen-Kouken-Nin) etc.

- When guardianship (Kouken), curatorship (Hosa) or assistance (Hojo) is commenced by adjudication of the family court, immediate notice must be provided in writing to the Depository Office of name of guardian for majority (Seinen-Kouken-nin) and other prescribed matter. When guardianship (Kouken), curatorship (Hosa), or assistance (Hojo) is commenced for the depositor by adjudication of the family court, immediate notice must be also provided in writing to the Depository Office of name of guardian for majority (Seinen-Kouken-nin) and other prescribed matter.

- When a supervisor of voluntary guardian (Nin-i-Kouken-Kantoku-nin) is appointed by adjudication of the family court, immediate notice must be provided in writing to the Depository Office of name of voluntary guardian (Nin-i-Kouken-nin) and other prescribed matter.

- When guardianship, curatorship or assistance has been commenced or a supervisor of voluntary guardian has been appointed, immediate notice must be provided as prescribed in the Paragraph 1 and 2 of this Article.

- Immediate notice must be also provided of any change in respect of any matter filed with Depository Office in accordance with the Paragraph 1 through 3 of this Article.

- The Bank is not responsible for any damages caused prior to the receipt of a written notice as provided for in the Paragraph 1 through 4 of this Article.

Article 19. Authenticity of Specimen Signature.

- The Bank is not responsible for any damages arising from forgery, alteration, or other wrongful acts in respect of withdrawal slips, checks, promissory notes, bills of exchange, or other items submitted to the Bank, so long as the Bank has verified with reasonable care the signature(s) appearing on such items (including seal impression(s) or signature(s) sent as images to the Bank as electromagnetic records) against the specimen filed with the Depository Office.

- The provisions of the preceding Paragraph shall apply mutatis mutandis to all damages that may result from imitation, alteration or misappropriation of check, promissory note, or bill of exchange forms used (including forms sent as images to the Bank as electromagnetic records), so long as the Bank has believed, with reasonable care, that the checks, promissory notes, or bills of exchange presented to it have been made on the proper forms mentioned in Article 10.

- The provisions of Paragraph 1 of this Article shall also apply mutatis mutandis to any damages which result from the violation of these Terms and Conditions of Current Accounts(hereinafter referred to as “the Terms and Conditions”), or any other directions issued by the Bank in regard to the use of Check, promissory note, and bill of exchange forms.

Article 20. Checks, etc., with Blanks

- In drawing checks, promissory notes, or bills of exchange, or in accepting bills of exchange, the depositor is required to fill in all blanks as completely as possible, as required by law for the validity of such instruments. Notwithstanding any omissions, the Bank may pay without notifying the depositor:

- checks, promissory notes. or bills of exchange payable on a fixed date which lack the drawing date; or

- promissory notes or bills of exchange which lack the payee’s name.

- The Bank is not responsible for any damages that may result from any actions taken in accordance with the preceding Paragraph.

Article 21. Crossed Checks

- The Bank may par the bearer of a crossed check that is presented for payment which bears on its reverse side the depositor’s (or his or her agent’s ) signature filed with the Depository Office.

- The Bank is not responsible for any damages covered by Article 38, Paragraph 5 of the Law on Cheques of Japan which arise from any actions taken in accordance with the preceding Paragraph. If, however, as a result of any such action the Bank is compelled to pay damages to a third party, the Bank shall be entitled to reimbursement from the depositor.

- The provisions of the preceding Paragraph shall apply to the checks drawn by the depositor’s agent by its own name, and the Bank shall be likewise entitled to reimbursement from the depositor.

Article 22. Inquiry Waived

- The Bank may pay any promissory note or bill of exchange without inquiring as to whether any necessary approval has been received, even if any endorsement to the promissory note or bill of exchange requires the approval of a board of directors or meeting of shareholders, or some other procedure of a similar type.

- The Bank is not responsible for any damages that may result from any actions taken in accordance with the preceding Paragraph.

Article 23. Interest

The Bank will not pay any interest on credit balances in the Current Account.

Article 24. Information on Balances

Upon request, the Bank will furnish the depositor with information on entries in or the balance of the Current Account in accordance with the procedures specified by the Bank.

Article 25. Prohibition of Transfer or Pledge

The depositor may not transfer or pledge the deposit in the Current Account.

Article 26. Restrictions of Transactions under the Current Account, etc.

- If the depositor does not respond to various kinds of confirmation or a request for document submission from the Bank by the time separately specified by the Bank without justifiable reason, the Bank may restrict some transactions under the Current Account, such as withdrawals.

- If the Current Account is not used for over one (1) year, the Bank may restrict some transactions under the Current Account, such as withdrawals.

- Upon request from the Bank, the depositor who resides in Japan without Japanese nationality shall report to the Bank pursuant to the method specified by the Bank that the depositor has a valid status of residence and period of stay. If the permitted period of stay filed with the Bank expires, the Bank shall be able to restrict some transactions under the Current Account, such as withdrawals.

- If the Bank determines that the depositor poses the risk of money laundering, terrorist financing or a violation of sanctions, after taking into account the depositor’s action in response to confirmation on matters regarding the identity or a request for document submission as set forth in Paragraph 1 of this Article, specific transaction details, explanations provided by the depositor and other circumstances, in light of the “BTMU Financial Service Anti-Abuse Policy” separately set forth by the Bank, the Bank shall be able to restrict the following account transactions.

- Unreasonably high-value or frequent cash transactions for deposits and withdrawals

- Overall foreign exchange transactions, such as cross-border funds transfers, foreign currency deposits, money exchange transactions and trade transactions

- Specific transactions that the Bank determined pose high risk of money laundering and terrorist financing and a violation of sanctions

- Notwithstanding restrictions of transactions under the Current Account, etc. set forth in Paragraphs 1through 4 of this Article, if a concern over money laundering, terrorist financing or a violation of sanctions is confirmed to be addressed by the depositor’s reasonable explanation or other means, the Bank may immediately lift restrictions of transactions under the Current Account listed in the preceding four (4) Paragraphs.

Article 27. Termination

- The Current Account may be terminated at any time at the discretion of either party. Notice of termination by the Customer shall be in writing.

- If the Current Account falls under any of the categories in any of the following items, the Bank may suspend transactions under the Current Account, or after serving the notice to the Customer, terminate the Current Account. If the Bank terminates the Current Account with the notice, the Current Account shall be deemed to have been terminated when the Bank dispatches the termination notice to the Customer’s name and address filed by the Customer with the Bank, regardless of the delivery status of the notice.

- It becomes clear that the Current Account holder does not exist; or that the Current Account was opened without the intention of the Current Account holder

- The depositor of the Current Account violates Article 25 of the Terms and Conditions.

- The deposit in the Current Account is utilized or at risk of being utilized for an act that violates laws and regulations or the public policy of decency in Japan and overseas

- The information confirmed in the process of customer identification set forth by laws, as well as the information confirmed and documents submitted in response to a notice from the Bank or other requests set forth in Paragraph 1 of Article 26 of the Terms and Conditions are false

- The Bank confirms that the deposit is utilized or at risk of being utilized for money laundering, terrorist financing or a transaction that violates sanctions, thereby determining that the Bank must terminate the Current Account to prevent these activities

- Any of the conditions relating to restrictions of transactions under the Current Account, etc. set forth in Paragraphs 1 through 3 of Article 26 of the Terms and Conditions are not resolved for over one (1) year

- The Customer does not respond to confirmation from the Bank without justifiable reason despite the fact that the customer is suspected of falling under any of the categories in items i through vi of this paragraph

- In addition to the circumstances set out in the preceding Paragraph, if the Customer falls under any of the categories in any of the following Items and if the Bank determines it inappropriate for the Bank to continue transactions with the Customer, the Bank may suspend transactions under the Current Account or, after serving the notice to the Customer, terminate the Current Account. The termination of the Current Account is valid at the point of which the Bank dispatches the notice even if the notice does not reach the Customer. The Bank shall not be liable for any damages incurred by the Customer, but the Customer shall be liable for the damages incurred by the Bank, due to such termination.

- In case that the representations and covenants made by the Customer at the time of application for the opening of the Current Account have proved to be false

- The Customer does not, and shall not in the future, fall under any of the organized crime syndicate, its member, its ex-member who left the syndicate as recent as less than five (5) years ago, quasi-member of any such syndicate, entity affiliated with any such syndicate, sokaiya corporate racketeer, blackmailer camouflaged as social movement activist or organized crime syndicate specialized in intellectual crime, and any entity or individual similar to any of the above (collectively,“Member, etc. of Criminal Syndicate”), nor fall under any of the following:

- for the Customer to have a relationship in which its business is deemed to be controlled by the Member, etc. of Criminal Syndicate

- for the Customer to have a relationship in which it is deemed to involve the Member, etc. of Criminal Syndicate in the management of the Customer’s business in substance

- for the Customer to have a relationship in which it is deemed that the Customer utilizes the Member, etc. of Criminal Syndicate unlawfully such as to implement its own unlawful interest of, or to inflict damages to, any third party

- for the Customer to have a relationship which it is deemed that it is affiliated with the Member, etc. of Criminal Syndicate by way of provision of fund or other interests

- for an officer or other person engaged in substance in the management of business of the Customer to have a socially reproachful relationship with the Member, etc. of Criminal Syndicate

- In case that the Customer, by itself or by utilizing any third party. commits any of the following acts:

- to make a threatening demand

- to make an unlawful demand beyond

- to utilize a threatening speech or behavior or illegal force in relation with any transaction

- to injure the reputation or interfere with the business, of the Bank by distributing a false rumor or through fraudulent means or unlawful influence

- to implement an act similar to any of the acts stipulated in A to D above.

- The Bank may terminate the Current Account at any time in the event of prolonged inactivity in the transfer of funds in the Current Account, repeated delay of deposits necessary to effect payments from the Current Account, suspension of payment by the customer, or other circumstances which are clearly indicative of a termination of the fiduciary relationship between the Bank and the customer.

- If a termination notice dispatched by the Bank to the Customer at its address as filed with the Bank cannot be delivered or delivery is delayed, such notice shall be deemed to have arrived at the time it normally should have arrived.

- If the Bank terminates the Current Account in accordance with the rules and regulations of a Clearing House demanding the suspension of transactions with the Customer that termination shall take effect immediately upon dispatch of the Bank’s termination notice, regardless of whether the notice reaches the Customer.

Article 28. Post-Termination Procedure

- Once the Current Account has been terminated, the Bank is not responsible for payment of checks or promissory notes drawn by the depositor or bills of exchange accepted by the depositor prior to the termination.

- Once the Current Account has been terminated, the depositor shall immediately return all unused check, promissory note, and bill of exchange forms to the Depository Office, and at the same time settle the Current Account.

Article 29. Clearing House Rules

- In addition to the terms of the Terms and Conditions, Current Account transactions are also subject to the rules and regulations of the applicable Clearing House.

- When the applicable Clearing House implements emergency measures due to unavoidable circumstances such as natural disasters or other local/national emergencies, then the Bank may take appropriate actions in accordance with these measures, such as paying promissory notes or bills of exchange presented for payment after the prescribed period for presentation has elapsed notwithstanding Article 9, Paragraph 1, by debiting the Current Account.

- The Bank is not responsible for any damages that may result from any actions taken in accordance with the preceding Paragraph.

Article 30. The Act on Utilization of Funds Related to Dormant Deposits to Promote Public Interest Activities by the Private Sector

If there is no account activity such as deposits and withdrawals for ten (10) years or more, such funds shall be fall under “dormant deposits” set forth in Paragraph (6) of Article 2 of the Act on Utilization of Funds Related to Dormant Deposits to Promote Public Interest Activities by the Private Sector, and the funds in such account shall be transferred to the Deposit Insurance Corporation of Japan pursuant to Article 7 of the Act. Rules on Dormant Deposits apply to dormant deposits.

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Current Account Regulations shall be interpreted in accordance with the Japanese original.)

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Current Account Regulations shall be interpreted in accordance with the Japanese original.)

Article 31. Changes to Rules

- If changes occur to the financial situation or other circumstances, or other reasonable circumstances are acknowledged, the provisions of these Rules or other terms may be changed by announcing changes through publishing on the Bank’s website or publicizing changes by another suitable method.

- The changes set forth in the preceding paragraph shall apply from the date of time established when announcing changes.

(Current as of October 1,2025)

Rules on Dormant Deposits

Article 1. Final Account Activity Date Relating to the Act on the Utilization of Dormant Deposits

- With regard to deposits, etc. (hereinafter referred to as “Deposits, etc.”) provided for in Paragraph (2) of Article 2 of the Act on the Utilization of Funds Relating to Dormant Deposits to Promote Public Interest Activities by the Private Sector (hereinafter referred to as the “Act on the Utilization of Dormant Deposits”), the most recent account activity date, etc. as used in the Act on the Utilization of Dormant Deposits shall be the most recent of the dates stated below:

- The date of the final account activity as stated on the bank’s website

- For deposits involving any circumstances prescribed in the next paragraph as circumstances with which the future enforcement of claims for those deposits is expected, the date prescribed in the following paragraph as the date on which the exercising of claims relating to deposits is expected

-

The date on which the Bank issued the depositor with a notice informing of the matters set forth in Paragraph (2) of Article 3 of the Act on the Utilization of Dormant Deposits

Limited to cases in which the notice has reached the depositor or cases in which one month has passed since the date of issuing the notice (excluding cases in which a notice is returned through no intention of the depositor by the latest of either the date after one month has passed or the date the bank preliminarily notified the Deposit Insurance Corporation of Japan) . - The date on which falling under Deposits, etc. prescribed in Paragraph (2) of Article 2 of the Act on the Utilization of Dormant Deposits

- Circumstances with which the future enforcement of claims for those deposits in Item 2) of Paragraph 1 means only those circumstances stated in each of the following items, and the date on which the exercising of claims relating to deposits is expected shall depend on the circumstances stated in each applicable item, and shall be the date prescribed in each applicable item.

- When there are deposit period, calculation period, or redemption period provisions Last day of such period (first maturity date for deposits that continue automatically)

-

When circumstances stated below occur after the first maturity date

Maturity date for the period that includes the date on which such circumstances arose

- Account activity circumstances (meaning circumstances stated as being “account activity circumstances” on the Bank’s website)

- The Bank issues a notice informing of the circumstances prescribed in Paragraph (2) of Article 3 of the Act on the Utilization of Dormant Deposits Limited to cases in which the notice has reached the depositor or cases in which one month has passed since the date of issuing the notice (excluding cases in which a notice is returned through no intention of the depositor by the latest of either the date after one month has passed or the date the bank preliminarily notified the Deposit Insurance Corporation of Japan).

- If payments relating to the deposits have been suspended due to laws and regulations, orders or measures pursuant to laws and regulations, or agreements – the date on which such suspension of payments is cancelled

-

If subject to compulsory execution, provisional seizure, or collection of delinquent national taxes with respect to Deposits, etc.

Date on which such proceedings close (deposits earmarked for taxes, separate deposits, deposits at notice, and cumulative deposits may not be considered account activity) - When expecting or were expecting to receive remittances, make transfers, or other deposits or withdrawals based on laws and regulations or agreements (limited to when the Bank is able to grasp anticipated deposits or withdrawals) Date on which the deposit or withdrawal occurred or date on which a decision is made not to make deposits or withdrawals

-

When circumstances stated in each of the preceding items have arisen withregard to other deposits pursuant to Rules on Integrated Accounts

Date of final account activity relating to other deposits

Article 2. Final Account Activity Date for Deposits Relating to Financial Instruments Made Up of Multiple Deposits (integrated accounts, etc.)

If circumstances have arisen with which any future enforcement of claims for those deposits is expected for deposits in integrated account transactions, etc., handling shall be as if such circumstances have also arisen for other deposits.

Article 3. Handling of Alternative Funds Such as Dormant Deposits, etc.

- If there are no transactions concerning Deposits, etc. for more than ten (10) years, claims to such deposits shall become extinct pursuant to the Act on the Utilization of Dormant Deposits, and depositors, etc. shall subsequently hold claims for substitute money for dormant deposits with respect to the Deposit Insurance Corporation of Japan.

- In cases set forth in the preceding paragraph, depositors, etc. may request payment of claims for substitute money for dormant deposits in relation to such funds via the Bank. In such case, when the Bank approves, depositors may receive payment of substitute money for dormant deposits by acquiring deposit claims held from the Bank.

- When circumstances stated below have arisen in the case set forth in paragraph 1, depositors, etc. shall commission the Bank in advance to make allegations and demand payments in accordance with Paragraph (2) of Article 7 of the Act on the Utilization of Dormant Deposits.

- When deposits are made by a third party or a deposit is made by the Bank by transfer, deposit or some other method with respect to Deposits, etc. and circumstances arise based on obligations prescribed in laws and regulations or agreements (excluding circumstances relating to interest payments)

- When bills or checks are presented or other demands for payment of claims have been made by third parties with respect to Deposits, etc. (limited to when the Bank is able to grasp such payment demands)

- When compulsory execution, provisional seizure, or collection of delinquent national taxes has occurred with regard to the right to claim payment of substitute money for dormant deposits with respect to Deposits, etc.

- When partial payment of substitute money for dormant deposits is made with respect to Deposits, etc.

- The Bank promises to demand payment of substitute money for dormant deposits in accordance with paragraph 3 on behalf of depositors, etc. only when the circumstances stated in each of the following items have been met.

- When the Bank is entrusted with payment operations by the Deposit Insurance Corporation of Japan relating to substitute money for dormant deposits with respect to Deposits, etc.

- If circumstances stated in item 2 of paragraph 3 have arisen with regard to Deposits, etc., when demanding payment of substitute money for dormant deposits from the Deposit Insurance Corporation of Japan with the aim of responding to demands for such payment

- If undertaking handling based on the preceding paragraph, when depositors, etc. make payments by acquiring deposit claims held from the Bank

- Following the extinction of claims for Deposits, etc. pursuant to the Act on the Utilization of Dormant Deposits with regard to this Article, this Agreement shall also apply to terminated deposit agreements

Article 4. Notification Method

The notification method set forth in Paragraph (2) of Article 3 of the Act shall be by post or by email.

Article 5. Changes to Rules

- If changes occur to the financial situation or other circumstances or other reasonable circumstances are acknowledged, the provisions of these Rules or other terms may be changed by posting changes on the Bank’s website or announcing changing by another suitable method.

- The changes set forth in the preceding paragraph shall apply from the date of expiration of the reasonable period of time established when announcing changes.

END

(Current as of January 1,2018)

(Current as of January 1,2018)

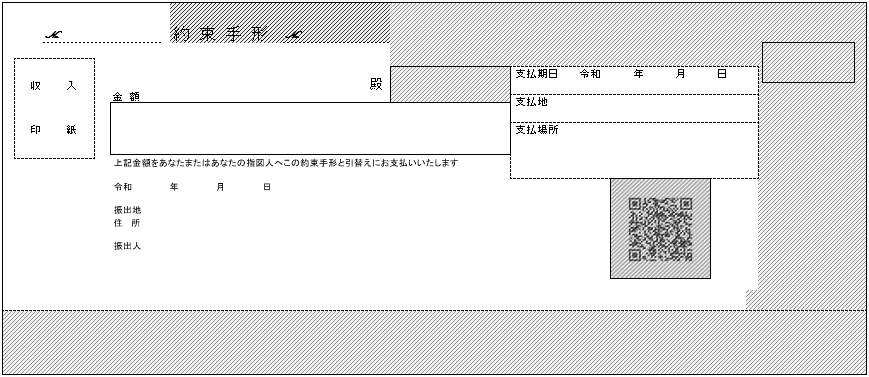

DIRECTIONS FOR USE OF BLANK PROMISSORY NOTE FORMS

- These blank promissory note forms can be used only for drawing promissory notes payable at the Depository Office at which you maintain a current account in your name. These forms cannot be used for any other current account or transferred to any other person.

- In drawing a promissory note, the amount, the address and the due date should be clearly written. When you affix your name and seal thereto, please use the seal the impression of which has been filed with the Depository Office in advance (hereinafter referred to as the “filed seal”. If the address is entered, the place of drawing may be dispensed with. In order to prevent alteration, please write in ink or other non-erasable substance.

- Please fill in the date of drawing and the payee since these are legal requirements.

- The amount must be entered in the space in the promissory note form specified for that purpose.

- When an amount is entered in Arabic figures, please use a check writer and print the mark “¥” immediately before the amount, print a mark such as ※ or ★ immediately after the amount, and print a “,” every three digits. Please do not restate the amount in words.

- When an amount is entered in words, please use letters listed in the table below which cannot be easily altered, without leaving space between the letters. Please enter the word “Yen” immediately before the amount and the word “only” immediately after the amount. Please fill in the form carefully using block capitals rather than cursive writing.

- Please do not make any entries in the amount section other than those listed in paragraphs (2) or (3). In particular, please ensure that signatures, seals and duplicate indications of the amount do not overlap the amount section.

-

When an incorrect amount is entered in a promissory note form, please use a new form instead of correcting the original form. When correction of any entry other than the amount is desired, please affix the filed seal to confirm the correction.

Please ensure that corrections, signatures and seals do not overlap the amount section, bank name or two-dimensional code section. -

Please do not make entries in the blank spaces marked by oblique lines as illustrated below, such as the upper right portion, right portion, and the clear band at the bottom of the blank promissory note form.

Please ensure that signatures, seals, duplicate indications of the amount, and other markings do not overlap the two-dimensional code section. - The blank promissory note forms should be kept with due care. In the event any blank forms are lost, stolen or misplaced, please immediately notify the Depository Office on the form provided by the Bank.

- New blank promissory note forms are available upon submitting the receipt form prescribed by the Bank with the name and filed seal duly affixed.

-

When the use of a signature is desired for these transactions, please use the signature in place of the name and seal. For correction of entries, the surname should be signed to confirm the correction.

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Current Account Regulations shall be interpreted in accordance with the Japanese original.)

● List of letters to use when entering the amount

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

Other acceptable letters: 金, 円, 圓 (alternative to 円), 億

- To prevent handling errors, please do not use any other variants or cursive letters.

(For Personal Current Account)

DIRECTIONS FOR USE OF BLANK CHECK FORMS

- These blank check forms can be used only for drawing on the Depository Office at which you maintain a current account in your name. These forms cannot be used for any other current account or transferred to any other person.

- Please confirm the balance of your current account when drawing checks. Also please note that the Bank will pay even a post-dated check if presented for payment.

- In drawing a check, the amount, date of drawing, etc., should be clearly written, and the authorized signature affixed. In order to prevent alteration, please write in ink or other non-erasable substance.

- The amount must be entered in the space in the check form specified for that purpose.

- When an amount is entered in words, please use letters listed in the table below which cannot be easily altered, without leaving space between the letters. Please enter the word “Yen” immediately before the amount and the word “only” immediately after the amount. Please fill in the form carefully using block capitals rather than cursive writing.

- When an amount is entered in Arabic figures, please use a check writer and print the mark “¥” immediately before the amount, print a mark such as ※ or ★ immediately after the amount, and print a “,” every three digits. Please do not restate the amount in words.

- Please do not make any entries in the amount section other than those listed in paragraphs (2) or (3). In particular, please ensure that signatures, seals and duplicate indications of the amount do not overlap the amount section.

-

When an incorrect amount is entered in a check form, please use a new form instead of correcting the original form. When correction of any entry other than the amount is desired, please sign your surname to confirm the correction.

Please ensure that corrections, etc. do not overlap the amount section, bank name or two-dimensional code section. -

Please do not make entries in the clear band at the bottom of the blank check form.

Please ensure that signatures, seals and duplicate indications of the amount do not overlap the two-dimensional code section. - The blank check forms should be kept with due care. In the event any blank check forms are lost, stolen or misplaced, please immediately notify the Depository Office on the form provided by the Bank.

-

New blank check forms are available upon submitting the receipt form prescribed by the Bank duly signed.

(This English translation is for the convenience of the depositor only. Any and all questions which may arise in regard to the meaning of the words, provisions and stipulations of these Terms and Conditions of Current Accounts shall be interpreted in accordance with the Japanese original.)

● List of letters to use when entering the amount

横スクロールして確認

| 1 | 2 | 3 | 4 | 5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 漢数字 | 壹 | 壱 | 弌 | 弐 | 弍 | 貳 | 貮 | 参 | 參 | 四 | 泗 | 肆 | 五 | 伍 |

| 6 | 7 | 8 | 9 | 10 | 100 | |||||||||

| 漢数字 | 六 | 陸 | 七 | 漆 | 質 | 八 | 捌 | 九 | 玖 | 拾 | 什 | 百 | 陌 | 佰 |

| 1,000 | 10,000 | |||||||||||||

| 漢数字 | 千 | 仟 | 阡 | 万 | 萬 | |||||||||

Other acceptable letters: 金, 円, 圓 (alternative to 円), 億

- To prevent handling errors, please do not use any other variants or cursive letters.