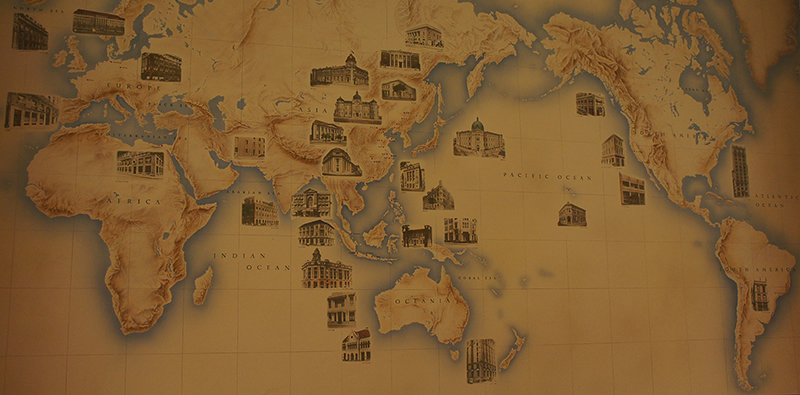

Yokohama Specie Bank's global network in the mid 1930s.

(Source: Kanagawa Prefectural Museum of Cultural History)

In 1954, the Bank of Tokyo turned itself into a specialized foreign exchange bank in line with the Foreign Exchange Bank Act. It has since been active on financial markets in New York, London, and elsewhere, taking the lead in internationalization of the Japanese economy and Japanese banks. The bank explored ways of raising funds in foreign currencies. It created a yen-yuan settlement system to help normalize trading ties with China at a time when payments were not allowed in U.S. dollars. The bank also used its strong overseas network to assist Japanese companies in advancing overseas.

The bank strove to develop the Tokyo foreign exchange market, enhance the yen's international credibility, improve its status as an international currency, and expand foreign exchange trading between the yen and other currencies in Tokyo, New York, and London.

The bank also played a role beyond that of a single private bank through its significant contributions to Japan's currency diplomacy and economic diplomacy in the Asian region through public-private partnerships with the Finance Ministry and the Japan Bank for International Cooperation. This tradition of active involvement in overseas expansion has been passed on to succeeding generations.