FAQ

Updated on October 27, 2023

How to Create a Payment (Payments and Transfers) (20)

Q.What kind of payment can be created using "Payments and Transfers"?

A.Payments and Transfers can create foreign remittance, book transfer and most domestic remittances (except UK Low Value Payment and SEPA Direct Debit, which are accessed from separate menus, if such services are enabled for customers).

Q.For "Payments and Transfers", how can I create an ISO20022 and a non-ISO20022 payment instruction from the instruction creation screen?

A.In case ISO20022 compliant settlement account is selected, Foreign Remittance (ISO20022), Domestic (Single) (ISO20022) or Book Transfer (ISO20022) can be selected to create an ISO20022 compliant payment instructions from the creation screen.

In case non-ISO20022 compliant settlement account is selected, you can select any payment type to create a non-ISO20022 payment instruction creation screen.

Q.On the payment creation screen, do the displayed fields change depending on the certain conditions?

A.Yes, available fields displayed on the screen depend on the settlement account and payment type that are specified on the Creation: Select screen.

Please follow the entry fields on the actual screen and input the details as necessary.

Q.When creating ISO20022 payment instructions, are there any additional mandatory fields in Beneficiary Information section, compared to creating non-ISO20022 payment instructions?

A."City" and "Country" fields in Beneficiary Information section are mandatory, when creating Foreign Remittance (ISO20022) and Domestic (Single) (ISO20022) payment instructions.

Q.When creating ISO20022 payment instructions, is it necessary to enter both "SWIFT BIC" and "Bank" information in the Beneficiary Bank Information section?

A.Either "SWIFT BIC" or "Bank" (e.g. Bank Name, Address, City and Country) information of the Beneficiary Bank section is required*.

Please note that based on ISO20022 standard, "SWIFT BIC" should be prioritized in case both are entered.

* This is not applicable to “Domestic (Single) - CHAPS” (ISO20022) payment type. Please refer to No. 6 for details.

Q.Will the input method for "Bank Code / National Clearing Code" field change for “Domestic (Single) - CHAPS” (ISO20022) payment instructions?

A.Input method for "Bank Code / National Clearing Code" differs depending on method and format during payment creation.

< When creating non ISO20022 payment instructions >

Either one of the following input formats are accepted for both screen input and file upload:

- 6-digit Sort Code

- "SC" + 6-digit Sort Code

< When creating ISO20022 payment instructions >

Either one of the following input formats are accepted for both screen input and CSV file upload:

- 6-digit Sort Code

- "GBDSC" *+ 6-digit Sort Code

For XML file upload, only the following is accepted:

- "GBDSC" + 6-digit Sort Code

* "GBDSC" is UK's ISO20022 clearing system identification code.

* For “Beneficiary List”, it is recommended that you only register the 6-digit Sort Code in the "Bank Code / National Clearing Code" field so it can be applied to both ISO20022 and non- ISO20022 payment instruction.

Q.Can Value Date be left as blank? Can approver(s) add/edit the Value Date later?

A.Yes, Value Date is an optional field for payment creation (input on screen), so it can be left as blank when applied. Approver(s)* can approve the payment instruction with the blank Value Date. In such case, Value Date will be automatically suggested by system.

Alternatively, approver(s)* can also use the Overwrite Value Date function to manually edit the Value Date.

*In case there are multiple approvers, partial approver can leave the Value Date as blank.

Please note that when you create instructions via file upload, Value Date should not be left as blank. If Value Date is blank or a past date is specified, error will be displayed.

Q.What is the furthest date I can select for a future value transaction?

A.The future/forward value date that can be set, differs from payment types within Payments and Transfers.

For Foreign Remittance, Domestic (Single) and Book Transfer, the date can be set within 20 calendar days from the current day.

For more details, refer to the GCMS Plus Online Manual.

Q.How do I know the entry requirement for "Purpose of Remittance" field?

A.For ISO20022 payment, click the " ? " Button on the right side of "Purpose of Remittance" field to show entry requirement for each country.

For non-ISO20022 payment, click the " List " Button on the right side of "Purpose of Remittance" field to show entry requirement for each country.

Q.What is "Regulatory Reporting" field and what need to be entered in this field?

A."Regulatory Reporting" field is used to enter regulatory requirement related information in compliance with ISO20022 standard and relevant country requirements.

The entry requirements of this field is based on the beneficiary's country and/or the settlement account's country. For reference on the entry requirements, click the " ? " button beside the field.

Q.How can I apply for using the "Beneficiary Advice" function?

A.Beneficiary Advice is only displayed for customers in case such service is enabled. Customer can apply for Beneficiary Advice via application form provided by bank.

Q.On Select Beneficiary List screen, are the search fields available for partial match?

A.All search fields are available for partial match and not case sensitive (except for some fields with fixed value).

Q.When creating a payment, what happens if there is no applicable approval flow for me to select?

A.In case no approval flow is available during payment creation, Default Approval Flow will apply automatically. Default Approval Flow refers to a two-level flow: apply and approve.

In case a multi-level approval flow should be used, please ensure to register necessary approval flows before creating a payment instruction.

Q.Can I create a new approval flow when I create a payment? Can I edit the approval flow after submitting to approver?

A.If approval flows are required, they should be registered in advance.

Approval flows can be selected only during payment creation. After the instruction is applied/submitted to approver, approval flow cannot be changed unless applier withdraw and edit the instruction.

Q.How can I check the payment data status after applying instruction?

How can I withdraw the instruction?

A.Go to Transaction Services > Payments and Transfers > Inquiry and Approval > Instructions. On Inquiry and Approval: Search screen, appliers can choose the Action Item as "Withdraw" and search the instructions that can be currently withdrawn.

Q.When uploading payment files, why the "Editable Instruction" and "Overwrite Value Date" are not available for me?

A."Editable Instruction" and "Overwrite Value Date" will only show in case file upload setting for the customer is "Editable Settings", which can be confirmed on Customer Profile: Inquiry screen (Administration > Customer Profile > Profile Inquiry).

Please note that customer registration is conducted by bank based on customer’s application form.

Q.Regarding payment upload, which type of file formats are accepted?

A.For non-ISO20022 payment, txt and csv upload file types are accepted.

For ISO20022 payment, txt, csv and xml upload file types are accepted.

Please note that in case file is encrypted with the public key provided by bank, other file types such as gpg etc. are acceptable.

For more details about the specifications of these upload files, refer to the GCMS Plus Online Manual.

Q.What is “public key” and how to use the public key to encrypt file?

A.Public key is used in file encryption service provided by the bank and can be downloaded by customer via the GCMS Plus screen (Administration > Reference > Public Key Download). Customer can upload a file encrypted with the public key to the GCMS Plus.

Basic steps for file encryption are as follows:

Step 1) Download the public key for creating an encrypted file from the GCMS Plus screen (Administration > Reference > Public Key Download)

Step 2) Create payment instruction data.

Step 3) Encrypt the upload file created in Step 2 using the public key downloaded in Step 1. Encryption software based on OpenPGP* is required for file encryption.

Step 4) Upload the encrypted file to GCMS Plus. The encrypted file is automatically decrypted upon upload.

*OpenPGP is a standardized version of commercial program (PGP: Pretty Good Privacy) for the encryption of files, emails, etc.

Q.Regarding the Copy function, how many months of previously approved payment instructions can be copied?

A.Instructions that are approved within 13 months can be copied.

Q.Can previously approved non-ISO20022 payment instructions be copied to create ISO20022 payment instructions?

A.No, due to difference in data fields, copying from non-ISO20022 to ISO20022 payment instructions is not accepted.

How to Inquire and Approve a Payment (Payments and Transfers) (9)

Q.Can multiple instructions be approved at once?

A.Yes, from the Instruction List, simply select one or multiple payment instructions regardless of their payment types and proceed to approve.

Q.What is the difference between "Instruction List" and "Transaction List" of the View Type on the Inquiry and Approval / PDF and Download :Search screen?

A.Customer can switch between the two view types, Instruction List and Transaction List.

- In case of Instruction List view type, the list shows by instruction unit, including "single instruction" and the summary information of a "group instruction". All actionable buttons would show in this view type.

- In case of Transaction List view type, the list shows each transaction, including "single instruction" and each transaction in a "group instruction". Only PDF button would show in this view type.

Q.On Inquiry and Approval / PDF and Download : Search screen, what will be the search result if I did not enter "To" for Value Date?

A.Search result will show all the available items from the specified date of "From" for Value Date.

Q.When can Overwrite Value Date function be used?

A.In case approver(s) need to edit the Value Date* set by applier, approver(s) can overwrite the value date by using the following functions:

Select the instruction(s) and click Overwrite Value Date button when available. And in the next screen, Inquiry and Approval: Overwrite Value Date screen, select either of the two below:

1) Overwrite Value Date by selecting "System-suggested Value Date".

GCMS Plus will suggest the shortest date possible based on service cut-off time.

2) Overwrite Value Date by selecting the manual entry field.

Manually entered date will apply.

* Please note that when applier set the Value Date as blank, approver(s) can approve the instruction(s) without manually entering date. In such case, GCMS Plus will automatically suggest a value date when approver(s) click the Approve button. Suggested value date can be confirmed from in Inquiry and Approval: Confirm screen.

Q.What is the purpose of "Approver's Comments" on Inquiry and Approval: Confirm screen?

A.Approver can leave comment such as reasons for approval or rejection of an instruction.

Please note that the comments entered are only for customer’s internal use and they will not be included in the payment data.

Q.What is the Floating Action Button (such as the one on the Inquiry and Approval / PDF and Download : Search screen)?

A.Floating Action Button (FAB) is the button that can show on the front side of the screen for an easy click. If you select any target instruction(s), the relevant buttons will appear automatically in front of all screen contents so that you can click the desired button without having to scroll down to bottom of the screen.

Q.Can a withdrawn/deleted instruction be retrieved? Will there be any records after the action is taken?

A.Yes, on the Inquiry and Approval / PDF and Download screen, status of "Saved (Withdrawn)", "Deleted" etc. can be confirmed from the Instruction List.

Record can also be confirmed on Instruction Details screen, or from User Activity Log (Administration > Log). Please note that the contents of the change cannot be tracked from the log.

Q.Can I print a summary list of instructions from the Inquiry and Approval screen?

A.Yes, use the standard function Print Page displayed on the upper right of the screen.

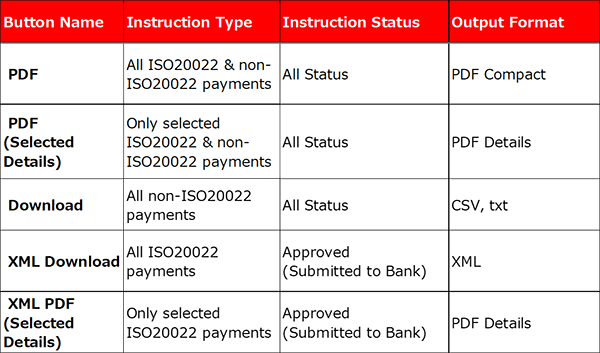

Q.What is the difference of "PDF", " PDF (Selected Details)", "Download", " XML PDF (Selected Details)" and "XML Download" buttons on the PDF and Download : Search screen?

A.Refer to the following table for the difference of each button.

How to Set Beneficiary List (Payments and Transfers) (10)

Q.What is a Beneficiary List? What is the benefit of using a Beneficiary List?

A.Beneficiary List is a convenient and common function for all payment types within Payments and Transfers, to register Beneficiary and Beneficiary Bank (and Intermediary Bank) as common data.

Registering frequently used information as master data can save time and avoid typographical errors when creating payment instructions.

Beneficiary List can be used in accordance with customer's internal control needs. If the use of Beneficiary List is set as mandatory, when creating payment instructions, appliers must select the pre-registered/approved master data.

Q.Is it necessary to set values for all items in Beneficiary List?

A.Beneficiary List: Input screen contain possible entry fields for all available payment types within Payments and Transfers. Please enter values only in the necessary fields that you actually use during payment creation.

Q.What is “Mandatory Use of Beneficiary List” function? In case “Mandatory Use of Beneficiary List” function is enabled, what are the required fields that need to be registered to Beneficiary List prior to creating ISO20022 payment instructions?

A.“Mandatory Use of Beneficiary List” is an optional function which enables customers to control Beneficiary Information in strict manner. In case “Mandatory Use of Beneficiary List” function is enabled, applier cannot create payment without Beneficiary List.

For ISO20022 payments, it is recommended to confirm in beneficiary list that the following mandatory fields are registered before payment creation.

・Beneficiary Information

"City/Town Name" and "Country"

・Beneficiary Bank Information

"SWIFT BIC" or set of "Bank Name", "City/Town Name" and "Country"*

*SWIFT BIC is recommended.

Q.Can a Beneficiary List be used for creating both ISO20022 and non-ISO20022 payment instructions?

A.Yes, applier can utilize the same Beneficiary List to create ISO20022 and non-ISO20022 payment instructions.

However, please note that to comply with ISO20022 standards, new input items are added, and the maximum number of characters allowed for some input items have been expanded.

1) For newly added ISO20022 input items (e.g., LEI, Post Code, etc.) in the Beneficiary List, these will not be included in non-ISO20022 payment instructions.

2) For number of allowed characters, no changes in maximum number of allowed characters for non-ISO20022 payment type. (an error will occur, if input exceeded maximum number of characters.)

Q.On the Beneficiary List: Input screen, why do some items have a pencil icon ( / )? What does it mean?

A.The pencil icon ( / ) indicates that the field cannot be modified on payment creation screen.

More specifically, when the use of Beneficiary List is set as optional, applier may or may not use Beneficiary List during payment creation. In case Beneficiary List is used, the fields with the pencil icon cannot be modified on the payment creation screen while other fields in the common data without the pencil icon can be further modified.

On the other hand, when the use of Beneficiary List is set as mandatory, applier must use Beneficiary List during payment creation. In such case, all the fields in the common data (including the ones without the pencil icon) cannot be modified on the payment creation screen.

Q.On Beneficiary List: Input screen, there is an item called "Reference". What is it for and how can it be used?

A.“Reference”, which is an optional field, can be used flexibly based on customer's needs. For example, it can be used to assign an ID to a Beneficiary List. It can also be used freely by customer to tag Beneficiary List with any additional and useful information, such as priority, sorting order, nicknames or any other context to make it easy to locate related Beneficiary List.

Q.Is another person's approval always required to create Beneficiary List?

A.No, users who are granted the "Execute" privilege for "Payments and Transfers Beneficiary List", can apply and approve all by themselves. The user settings can be done in the Administration > User Profile.

Q.Is it mandatory to set Approval Flow for each beneficiary? What will happen if I do not select a specific Approval Flow when creating a beneficiary?

A.It is not mandatory to set Approval Flow for each beneficiary. If you do not select a specific Approval Flow for the beneficiary, when creating payment instruction, other available multi-level Approval Flows (if any) will apply.

In case a multi-level Approval Flow should be used, please make sure appropriate Approval Flow is registered before creating a payment instruction.

Q.How can I check in the system if the Beneficiary Advice service is enabled for my company or not?

A.Please go to Administration > Customer Profile > Profile Inquiry, and check if Beneficiary Advice is enabled or not.

In case Beneficiary Advice is not enabled, customer can apply via application form provided by bank.

Q.What kind of files are accepted for Beneficiary List upload?

A.Uploaded file should be in txt or csv.

Please note that in case file is encrypted with the public key provided by bank, other file types such as gpg are acceptable.

Q.Where can I set up the Approval Flow?

A.Please go to Administration > Customer Profile > Approval Flow Registration / Inquiry.

Q.What is the purpose of Approval Flow setting?

A.Customers can create Approval Flow(s) to meet detailed approval conditions such as multiple approval levels, specific approvers, amount range and etc.

By creating Approval Flow Patterns, multiple Approval Flows can be created.

A.Users with Apply privilege for approval flow.

Q.I want to register the Approval Flow but why is the "New" button not showing on the screen?

A.If you do not have the Apply privilege for approval flows, the "New" button for registering new approval flows will not be displayed.

Please go to Administration > User Profile > Profile Revision / Inquiry to apply for the user privilege.

Q.Why cannot I find a specific approver from the approver list when setting the Approval Flow?

A.Please go to Administration > User Profile > Profile Revision / Inquiry to check if that specific user has Approve privilege or not.

Q.How many Approvers can I set for each approval level?

A.Maximum 3 approvers can be set in each approval level.

Q.Are there any problems if I do not set any Approval Flow?

A.If specific Approval Flow(s) are not necessary, there is no need for customers to create any Approval Flow in GCMS Plus.

If Approval Flow is not created, the Default Approval Flow will apply automatically. The Default Approval Flow refers to two-step flow of "Apply" and "Approve" (all users with Approve privilege can approve).

Q.Where can I select the Default Approval Flow (for Payments and Transfers) ?

A.In case there are no registered Approval Flows, the Default Approval Flow is applied automatically during payment creation and the Default Approval Flow will not be displayed from the pull-down menu on Creation: Confirm screen. When payment instruction is applied, it will be circulated to all users with Approve privilege.

In case there are any registered Approval Flows, and you want to have the option to select the Default Approval Flow in addition to those registered Approval Flows, you can apply to the bank via application form, to enable the "Use of Default Approval Flow in Payments and Transfers" setting (which can be confirmed from Administration > Customer Profile > Profile Inquiry).

Q.Why is "Approval Flow Pattern" necessary and how can I add one for a specific Approval Flow?

A.In case multiple Approval Flows are necessary for Payments and Transfers, please create multiple Approval Flow Patterns and register Approval Flow.

Note:

When creating Approval Flow, you can link the Approval Flow with only one item shown in the Function/Approval Flow Pattern List.

If one Approval Flow is sufficient for Payments and Transfers, please select "Payments and Transfers Instruction" shown by default in the Function/Approval Flow Pattern List. In this case, there is no need to register any Approval Flow Pattern.

If multiple Approval Flows are necessary, please create multiple Approval Flow Patterns first. After that, the Approval Flow Patterns will be added to the Function/Approval Flow Pattern List. Then please apply them to separate Approval Flows.

When multiple Approval Flows are created, applier can select them during payment creation, from Approval Flow Name pull-down menu on Creation: Confirm screen.

Q.Where can I check the detailed privilege for each user?

A.To check user privilege, please go to Administration > User Profile > Profile Revision/Inquiry.

Q.Who can set User Profile and who can apply/approve User Profile revisions?

A.In principle, two administrators are in charge of User Profile registration and revision.

An administrator enters the user information, another administrator approves it.

As for a normal user (other than an administrator), in order to revise a user profile, you will need to have the "Apply" privilege for "User Profile Administration".

Q.How can I change (add/delete) the Administrator privilege?

A.Administrator privilege setting is done by the bank based on customer's application form.

In case you need to change this privilege, please submit user maintenance application form provided by bank.

Q.How can I enable or disable email notifications for Approval Flow in GCMS Plus?

A.In the User Profile: Entry screen (Administration > User Profile > Profile Revision/Inquiry), tick or untick the checkbox for "e-mail Notification for Approval Flow" to enable or disable notifications for Approval Flow related requests and rejections.

Please note that if you want to disable all emails from COMSUITE & GCMS Plus, please delete the e-mail address registered in "e-mail Address" field.

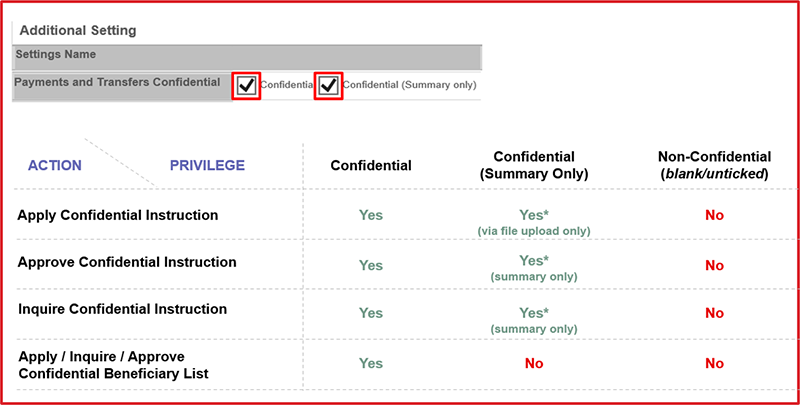

Q.What are the differences between "Confidential" and "Confidential (Summary Only)" in the Additional Setting?

A.User privilege for Payments and Transfers Confidential can be set in addition to usual Apply and Approve privileges.

"Confidential" allows users to inquire, apply, and approve a confidential instruction;

Whereas "Confidential (Summary Only)" allows users to inquire and approve a confidential instruction but only the summary of the instruction can be seen. (i.e., users are only able to check the information from the instruction list but cannot see instruction details as the view (magnifier) button is not displayed.) In this case, please note that instructions can be applied via file upload. Please manage information security by yourself as necessary, such as by using encrypted files etc.

In case neither privilege are granted, user (applier/approver) can only apply/approve non-confidential instructions.

Also refer to the summery below.

Q.What is an Execute privilege and how can I use it?

A.Execute privilege refers to the user privilege to conduct both "Apply" and "Approve" on your own. For Payments and Transfers, Execute privilege for Instruction and Beneficiary List can be granted to users. Please note that to grant Execute privilege to a user, that user must first have "Apply" and "Approve" privileges.

For users with the Execution privilege, you can approve your own data (application of Instructions, or Beneficiary List). Alternatively, you can still have another approver to approve the data you created.

For users without the Execute privilege, you cannot approve your own data (required to be approved by another approver).

How to Set Base Currency and Exchange Rate(12)

Q.How can I check the Base Currency and Exchange Rate set in GCMS Plus?

A.After logging into GCMS Plus, go to Administration > Customer Profile > Base CCY & Ex. Rate Registration / Inquiry screen to check the Base Currency and Exchange Rate.

Q.Who can register Base Currency and Exchange Rate?

A.Administrators.

In principle, your company needs to have two or more Administrators to perform security administration in GCMS Plus.

The basic flow for Base Currency and Exchange Rate is below:

1. One Administrator* to apply

2. Another Administrator* to approve

*In case Administrator is locked out, generally, please request other Administrator/User in your company to apply for Password Reset.

Then ask another Administrator to approve. If all Administrators are locked out, please contact your MUFG Bank contracting branch/office.

Q.When is it necessary to conduct Base Currency and Exchange Rate settings?

A.Before your company starts using GCMS Plus Services. Base Currency and Exchange Rate play an important role in daily GCMS Plus operations.

Make sure they, along with User privileges are properly set, before starting GCMS Plus Services.

Q.What is Base Currency in GCMS Plus?

A.Base Currency is the calculation basis for the GCMS Plus for transactions in various currencies.

It is used to for the following purposes:

1. Convert account balance information of multiple accounts into the Base Currency

2. Confirm whether a payment instruction exceeds user’s limit amount of transfers

Q.What is Calculation Method? How this setting affects Exchange Rate?

A.Calculation Method determines how you want to show the Base Currency.

You may choose either of the two methods below from the Calculation Method pull-down menu.

1) The number of units of Base Currency for one unit of the currency (if your Base Currency is USD, then this method indicates, e.g., JPY1 = USD0.01)

2) The number of units of the currency for one unit of Base Currency (if your Base Currency is USD, then this method indicates, e.g., USD1.00 = JPY100)

When you set the exchange rate details, the entered figures indicate the rate for each currency by the selected Calculation Method.

Q.How will the registered Exchange Rate be used?

A.Similar to Base Currency, Exchange Rate registered on GCMS Plus is used for the following purposes:

1. Convert account balance information of multiple accounts into the Base Currency

2. Confirm whether a payment instruction exceeds or not user’s limit amount of transfers

Therefore, regular review and update on the Exchange Rate is recommended.

Q.Are there any concerns if I want to change the Base Currency?

A.When the Base Currency is changed, the limit amounts of transfers set for each user will be cleared to zero.

Limit amounts (which can be found in Administration > User Profile) include:

1. Max Number of Daily Transfers

2. Limit Amount of Transfer per Transaction

3. Limit Amount of Daily Transfers

Users may not be able to approve payment instructions unless the limit amount of transfers are reset. Therefore, it is highly recommended that you change the Base Currency after confirming there are no payment instructions that are waiting for approval.

Q.Is GCMS Plus Exchange Rate different from the actual market exchange rate?

A.Yes, Exchange Rate on GCMS Plus is different from actual exchange rate existent in the market.

Exchange Rate on GCMS Plus is used to calculate and check the limit amount. It is registered on customer side, usually by using the in-house exchange rate/internal rate.

Therefore it does not correspond with actual exchange rates in the market.

Q.What is the “Rate by Bank” on COMSUITE Portal Top Page? How often is the data updated?

A.Rate by Bank is a feature released on December 28, 2020. Rate by Bank is:

1. The reference exchange rate to each GCMS Plus user for converting and displaying cash balance on COMSUITE Portal,

2. The middle rate of the market provided by MUFG Bank as indications,

3. Updated around 11:00 (AM) Japan Standard Time on weekdays. If the latest rate is not applicable due to holiday etc., the previously updated rate would still apply.

Q.Is the “Rate by Bank” on COMSUITE Portal Top Page also applicable to GCMS Plus?

A.No. Rate by Bank is currently only applicable to COMSUITE Portal Top Page to display cash balance. Rate by Bank has no impact to, thus, does not replace Exchange Rate registered on GCMS Plus.

Q.Can I use “GCMS Plus Exchange Rate” on COMSUITE Portal Top Page?

A.Yes. Go to COMSUITE Portal Top Page and click Settings.

Q.When should I choose “Rate by Bank” setting and when should I choose “Rate registered on GCMS Plus” setting?

A.Rate by Bank is the default setting and it is updated on each weekday to keep up to date with your cash balance display on COMSUITE Portal.

For GCMS Plus Customer, to use Rate registered on GCMS Plus, make sure the exchange rate on GCMS Plus has been correctly registered. Such rate is used for calculations within GCMS Plus for payment creation and approval and usually it can be the company’s internal rate. If you prefer to apply such exchange rate to convert cash balance on COMSUITE Portal, you can change that in the Settings from COMSUITE Portal.